|

v

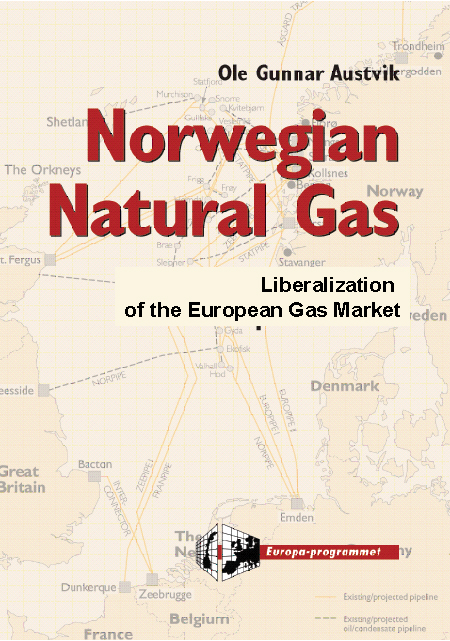

Liberalization of the European Gas Market Oslo: Europa-programmet 2003. ISBN

82-91165-30-0. 272 pages (24*17 cm). You can download the entire book for free here.

|

|

Norwegian Natural Gas; Liberalization of the European Gas Market is a comprehensive analysis of the ongoing market liberalization of European gas markets and Norway’s role as a major gas exporter. The book argues that liberalization of a market for a non-renewable resource like natural gas presents substantial challenges for the regulator as well as the regulated. It also demonstrates that the rent to be distributed in the gas chain, will make the European gas market more politicized than most other markets in the world for the foreseeable future. The processes are important not only to Norwegian and European economic interests and trade, but also to diplomacy, foreign and security policy.

1 Norwegian Challenges in the European Gas Market ......................................................... 12

Perspective2 Market Developments and Changes ................................................................................... 22

Towards A More Liberal Market

Prices, Taxes and Contracts

Organization of the Norwegian Petroleum Industry

Foreign and Security Policy Aspects

Chapter ContentsA Regional Market in Strong Growth3 Towards More Volatile Prices ............................................................................................... 42

Huge Investments and Long-term Contracts

EU Efforts to Liberalize the Market

Organization of Norwegian Gas Production and Sale

The Reorganization in 2001

Norway’s Significance in the MarketContractual Clauses4 The Important Role of Energy Taxation ................................................................................ 53

Prices in Today’s Market

Changes in Gas Prices

Price Effects of a Liberalized MarketEnergy Taxes: Higher and Higher5 Must Producers Earn a Resource Rent? ............................................................................... 69

Environmental Questions and The Kyoto Protocol

Price Effects of Consumption Taxes in a Market

The Parallel to Monopolization of the Supply side

Effects of Gas Taxes in the “Old” Market

Effects of Gas Taxes in a Liberalized Market

The Future Development of Energy TaxationThe User Cost6 Competition and Regulation of Transmission and Distribution ............................................ 87

The “Hotelling rule”

The Role of a Backstop Technology

Choice of Discount Rate

Changes in Reserves, Demand Elasticity, Economic Growth and Technology

The User Cost and Uncertainty

Monopoly vs Competition

Producer Prices May Fall over Time

Consumer Prices May Rise Over TimeHigh Costs of Transportation7 Regulatory Challenges ......................................................................................................... 112

Natural Monopoly

Economies of Scale

Economies of Scope

Limits to Market Power

Natural Monopolies in the European Gas Market

Transportation of Gas on the Norwegian shelf

Transportation Tariffs as per 2002

GasLedMaximizing Social Welfare8 Schedules for Regulatory Regimes ...................................................................................... 132

Laissez-faire, Nationalization or Regulation?

Regulation as a “Second-best” Approach

Conflict and Cooperation in European Gas Regulations

Conflict With the Regulator

Cooperation with the Regulator

Pay-off-matrixes for Transporters and the Regulator

Conflict or Cooperation?Rate-of-Return (ROR) Regulation - the "A-J-Effect"9 Experiences from North America and Great Britain ........................................................... 161

Price Discrimination – “Ramsey Pricing”

Subsidizing to Marginal Cost Pricing

Multipart Tariffs

Access / Usage Tariffs – “the Coase Argument”

Block Rates

Determining Optimal Capacity

Pricing in Peak and Off-Peak Periods – “Riordan Regulation”

Alternatives to Regulation

Public Ownership / Changing Property Rights

Market Forces versus RegulationThe United States10 Norwegian Gas in International Affairs .............................................................................. 174

Canada

Great Britain

Relevance for the Continental European MarketEnergy and Politics11 Strategic Gas Reserves and EU Security-of-Supply ......................................................... 194

Soviet Gas Export and American Interests in 1982

Economic Pressure as a Foreign Policy Instrument

Economic Warfare

Tactical Linkage

Strategic Embargo

Why did the US boycott fail?

Norwegian Reactions and Strategy

Gold Dust Parity?

Could Alternative Norwegian Strategies Have Been Implemented More Successfully?

Can a Similar Situation Occur Again?Import Dependency in the European Gas Market12 Effects of a Liberalized European Gas Market ................................................................. 207

When is Import Dependency a Problem?

Security of Supply of European Gas

The Environmental Benefits of Natural Gas

Strategic Gas Reserves (SGR)

Stocks, Conservation and Switching PoliciesNew Liberalism: The Interaction Between Visible and Invisible Hands13 Norway as a Major Natural Gas Exporter ......................................................................... 230

The Analysis of the Market

What is a Perfectly Liberalized Market?

Prices and Excise Taxes

Contractual Forms and Modulation

Consequences for Long-Term Contracts

“Old” Contracts

Incentives for New, Long-Term Contracts

Security-of-Supply

Environment and Environmental PolicyThree Periods in Norwegian Natural Gas DevelopmentsReferences .............................................................................................................................. 250

Reorganization of the Norwegian Gas Industry

Threatening Gas Taxes

Norway, Russia and the EU

The Role of the Government

Security-of-Supply

Norwegian Foreign and Security Policy

The Need of a Gas StrategyIndex ....................................................................................................................................... 260

REVIEWS:

Nuovo Geopolitica, Instituto Studi Geopolitici e Geoeconomici, Roma: Anno II, Numero 9, Marzo - Aprile 2003, page 40:

"Ottimo ed interessante studio sul processo di liberalizzazione del mercato del gas in Europa condotto da un ricercatore di Europa-programmet, struttura indipendente norvegese attiva nel campo della ricerca interdisciplinare.

Il volume, redatto secondo l’ottica di uno dei più importanti paesi europei produttori di gas, analizza con precisione e dettaglio ogni sviluppo del mercato europeo, soffermandosi su ogni singolo elemento di specifico interesse regionale e locale. In conclusione viene presentato lo scenario per una sicurezza nell’approvvigionamento di gas europeo ed una prospettiva di sviluppo del mercato del gas in Norvegia."Unauthorized translation:

"Very good and interesting analysis of the liberalization processes in the European gas market, written by a researcher at the Europa-programmet, an independent research institute in Norway dealing with interdisciplinary research.

The book has been written with a view from one of the most important European gas producing countries. It analyses in detail the development of the European gas market, studying every element of specific regional or local interest. Eventually the author presents scenarios for security-of-supply of European gas and for Norwegian gas developments."

The Journal of Energy Literature, Oxford Institute of Energy Studies (www.oxfordenergy.org), Oxford UK, Vol August 2003:"This book is a compilation of many reports and papers produced by the author through the 1990s and set in the context of the 2002 business environment. These have been brought together in the light of the liberalisation of the European gas market and Norway’s response to it. The work has had Norwegian government financial support and is part of the ongoing programme of the independent Norwegian research centre, Europa-programmet, to assess developments in Europe and their consequences for Norway.

As a result, the work has a strong Norwegian flavour and because it is wide ranging, well researched and well written, it has considerable value to anyone wanting to understand Norwegian attitudes and how these have developed. It begins with a summary of the challenges that the country faces as it develops its gas resources, including the break-up of the GFU, the state-controlled negotiating committee, and the changing nature of the gas contracts themselves from long term to those with shorter varying terms to meet changing customer needs.

There then follows a description of the European gas market and the liberalising European legislation. The changes this creates in the Norwegian organisation of sales, transportation, and control of state production interests are reviewed. Pricing mechanisms are outlined in the ‘old’ existing structure together with comment on the way liberalisation of the market may change price formation.

The author’s academic work in the field of energy taxation and his analysis of the right of producers to earn a rent for exploitation of their non-renewable resources then comes to the fore in the next two chapters. In discussing transmission and distribution, he again provides a theoretical analysis of the way the cost of a service and the demand for it can be analysed under different market structures ranging from a natural monopoly to a competitive market. This chapter then concludes by describing the Norwegian transportation arrangements in useful detail.

A considerable amount of analysis of the challenges faced by regulators and the economic effects of differing regulatory regimes is covered in the next two chapters. As in the case of other chapters covering economic issues, the work is not written from a particularly Norwegian perspective and the way it is written reflects the nature of the book as a whole in that it is a collection of relevant papers rather than a work that has been written with a common objective in mind. This is not a criticism as such, for all the work is interesting, but had it been written with a common thread and perspective it could have been even more successful.

Having said that, the final chapters provide so much of interest that it may not be possible to do them justice in a review such as this. The relevance of experiences drawn from North America and Great Britain for the Continental gas market is well covered. The author then turns to the role of Norwegian gas in international affairs. This is a revealing chapter, which lays out the US actions in respect of Soviet gas exports to Europe from the early 1980s and then describes the importance placed by the Americans on the development of Norwegian gas as a way of limiting the growth of Soviet gas sales. He suggests that Norway’s international energy policies should be flexible to take the best advantage of market conditions and leverage to its maximum advantage the relative scale of the country’s production – bearing in mind that in the case of energy, Norway has no overall joint interest with any other country. This is in contrast to its security interests which require it to act in conjunction with others.

A discussion of the issues of security of supply and import dependency is treated primarily from an academic point of view with some references to actual European situations. The subsequent analysis of the effect of liberalisation of the European gas markets on Norway as a producer is excellent and wide ranging and recommended reading for its breadth and coverage: in particular the effects on prices and taxes, contractual forms and modulation, existing and new long-term contracts, security of supply and environmental concerns are well covered.

The concluding chapter reviews the impact of a more liberal European gas market on the way that Norwegian gas strategy has been formulated and the changes recently made to the organisation of production, transportation and sale of natural gas. It also applies to energy-related policies of the EU and EU countries and the strategies of other natural gas exporters, like Russia. Some implications of foreign and security policy characteristics are discussed.

This book should be read by anyone with any interest in European gas matters and in particular Norway’s role in providing a vital part of the overall European supply portfolio. Academics and those with commercial interests or policy makers could all enjoy different parts of the work. Thoroughly recommended."

Ian Wybrew-Bond*** Please send en e-mail to inform about corrections to the manuscript.

top of page

Errata:

The corrections wil be listed on this page.Missing references in List of Literature:

- Page 188 - footnote 51: "Soviet" should be replaced with 'Russian' in line 2 and 3.

- Page 195 - line 8: ..."as a result of increased domestic consumption can...".

- Page 198 - line 8: ..."...foreign producers gain (only) CDJO, while CFO will be higher costs due to higher domestic EU production."

- The point O is omitted in Figure 11.2 and should be marked where a vertical line from point C intersects the P1-line.

- Hogan W.H. & Mossavar-Rahmani B., 1987: Energy Security Revisited. Harvard International Energy Studies no. 2. Energy and Environmental Policy Center, John F. Kennedy School of Government, Harvard University.

- Hubbard, R.G & Weiner, R, 1982; The 'Sub-Trigger' Crisis: An Economic Analysis of Flexible Stock Policies, Discussion Paper H82-07. Energy and Environmental Policy Center, Kennedy School of Government, Harvard University.

top of page

Norsk gass, naturgass, gassdirektiv, EU, Europeiske Union, regulering, regulator, transmisjon, liberalisering, liberalisme, energiskatter, avgifter, Gassforhandlingsutvalget, GFU, Forsyningsutvalget, FU, Naturlig monopol, Oljedirektoratet, OD, Olje- og energidepartementet, OED, Statoil, Norsk Hydro, Petoro, Gassco, GasLed, Norge, Russland, Tyskland, Ruhrgas, Gaz de France, EØS, leveringssikkerhet, ressursrente, grunnrente, naturgass, monopolrente, rente, økonomisk teori, reguleringsteori, reguleringsøkonomi, ikke-fornybare ressurser,