|

Strategic Gas Reserves and EU Security-of-Supply Energy

Studies Review Vol 12 no 2 Spring 2004

Download as pdf-file Download the article from Berkeley Electronic Press here |

Introduction

Energy security is back at top of the political agenda. Prime reasons

are tighter energy markets in general, high capacity utilization in OPEC

oil production and a volatile Middle East. As European demand for natural

gas is rapidly growing, the European gas market may eventually become tight.

When the market is liberalized, prices will react more directly than before

with regard to whether or not there will be sufficient supplies to meet

demand growth. It is of significant interest how a potential disruption

of supply from one source, possibly Norway, Algeria or Russia, or another,

caused by nature, military, political or economic reasons, could be dealt

with among consuming European countries, as addressed in EU (2002).

This paper argues that the risk for disruptions in supplies may be viewed as a negative externality in imports and, thus, consumption of gas for EU countries. At the same time, increased gas consumption entails positive environmental externalities as compared to oil and coal usage. It also involves a positive reduction of dependence on Middle East oil. This paper demonstrates how these positive externalities can be balanced against the risk of import disruptions.

To improve security-of-supply in the long-run it is necessary for the EU to develop regulation and market structures in ways that mitigate price volatility and keep them at sufficient levels, in order to make producers invest in long-term, huge and costly field developments and infrastructure. One problem that market liberalization creates is that the lower prices resulting in the short and medium term are not providing enough incentive for long-term investments. The lead-times between when decisions are made and the project actually is on stream are especially long when the fields are huge and a long distance from the market, as is the case for Europe. Lack of investments in the short and medium term creates shortages and higher prices in the long-term. It is thus a conflict between short and long-term interests also for the consumer.

In an emergency situation the establishment of Strategic Gas Reserves (SGR) is argued for as a means of mitigating prices, together with short-term arrangements that can move gas demand to other energy sources. The pure existence and possible use of SGRs also have the potential of working as insurance against price spikes ever to take place. This is parallel to how the Strategic Petroleum Reserves (SPR) and the International Energy Agency’s (IEA) crisis program should work under an oil crisis.

WHEN IS IMPORT DEPENDENCY A PROBLEM?

Dependency for a consuming country is often defined as a situation where it does not possess the capacity to produce 100 per cent of its own needs (Hogan & Mossavar-Rahmani, 1987:8). According to this definition, most countries are dependent on imports of a whole range of commodities. Dependency is thus a normal state of affairs. A country can be sensitive, vulnerable or neither in its dependency of the commodity when it's price or availability changes. This will be a function of the magnitude and duration of the change, the country's ability to adjust to the changed environment and the importance of the commodity in the economy. Obviously, changes in the supplies of gas are more important for most countries than changes in the supplies of, for example, widgets.

Sensitivity dependence is measured by the degree of responsiveness within an existing policy framework. It may reflect the difficulty to change policy within a short time and/or bindings to domestic or international rules. Vulnerability dependence, on the other hand, is a measure of the ability to adjust to changes in the availability or price of a commodity on which the country depends. Thus, vulnerability is represented by the costs caused by external price shocks even after policies have been altered. In economic terms, vulnerability can be represented by the potential for significant losses of output or welfare. Sensitivity dependence, on the other hand, does not need to induce a welfare loss in the long run when circumstances change. As dependency on imports is a normal state of the economy, government policies should aim at eliminating or reducing sensitivity and vulnerability dependence.

The costs of the dependency on imports of a commodity are measured both by increased expenditures on imports as well as the costly effects of changes on societies and governments due to more difficult access to the commodity. The change in policy will depend on political will, governmental ability, resource capabilities as well as international rules. A sensitivity dependence occurs in "the short run or when normative constraints are high and international rules are binding". A vulnerability dependence occurs when "normative constraints are low, and international rules are not considered binding" (Keohane & Nye, 1977). Thus, a country's vulnerability dependence can be significantly different from its sensitivity dependence, and potentially much more costly.

A country can become more sensitive or vulnerable in a given state of dependency if the commodity originates from one powerful state as opposed to if it is multilaterally dependent. It will also depend on whether the supplying nations are antagonistic or friendly in their relations to the purchasing country. In the oil market this has proved to be of great significance for example during the oil crisis in the 1973/74 when the oil exporting countries and OPEC actually wanted to hurt Western economies politically, and even introduced embargoes against oil sales to the United States and Holland. The question who controls Persian gulf oil supplies later have been, among other things, a question whether or not producing countries’ governments are hostile to the West (as expressed by the “haws” and “doves” in OPEC relations). In Europe, the fear that the Soviets could turn off the natural gas exporting taps during the cold war, made President Reagan introduce an embargo in 1981 on supplies of equipment from the West to reduce important dependence on Soviet gas.

Stability of the domestic policies within producing countries also play an important role as well as relationships to and stability of countries through which the gas is transmitted. The latter has been a question for Russian gas transported through Ukraine, and is an important reason for the Russians to develop more routes for the gas to reach EU countries, as the route through Byelorussia and plans for a new one through the Baltic Sea. Foreign politics will therefore be an important instrument for reducing sensitivity and vulnerability dependency by reducing the chance that the problem (too high and volatile prices) actually will occur, in addition to domestic policies designed to deal with and adapt to the problem when it eventually is coming.

It is important to notice that sensitivity or vulnerability dependence can occur even if a country does not import gas from any "risky" source at all. If the price of imports from 'secure' sources varies with the insecure sources the problem for countries importing from "secure" sources still persists. During a disruption many customers can normally purchase the natural gas or energy they want (unless perhaps it comes to an armed conflict). The problem for these is that the disruption may lead to so much higher energy prices that serious damages are inflicted on the countries' economies. This is well known in the oil market, but may become valid for a liberalized European gas market, as well. Parts of gas demand will during a crisis switch to oil, coal or electricity and push these prices up, in the same way that oil prices influence other energy prices. However, customers that are not able to switch and are linked to the one pipeline where supplies are interrupted may be forced to scale back operations or shut down. Entire countries that do not have infrastructure or appropriate capacity and are in the right locations to access gas from alternate sources may suffer heavily. Today, this is the situation for most former Soviet block countries still depending 100 % on imports of Russian natural gas. Thus, security of supply for European gas consuming countries is a question both of the pure physical access to the gas, the economic cost due to rising gas (and, hence, energy) prices during a crisis and the political pressure that can be brought on them by parties controlling supply, accidents etc.

In the following discussion, the security problem is related to the magnitude of imports. The quality of this measurement for sensitivity and/or vulnerability dependence should be modified. For example, if two countries import the same amount of gas and one of them has the option to shift to alternative energies or increase domestic production and the other not, the first country is less vulnerable than the other. The speed of the adjustment of demand and supply is important in determining the degree of sensitivity/vulnerability in the short and the long term, respectively. If a country changes from being inelastic in it's demand for imports in both the short and long term; to inelastic in the short and elastic in the long term, the country's dependence on imports may change from vulnerable to sensitive.

NATURAL GAS CONSUMPTION AND SECURITY-OF-SUPPLY PROBLEMS

Let us assume that a gas consuming country also has some domestic production, as illustrated in figure 1. For simplicity, we just call this the "EU market". The long run supply curve for EU domestic production is represented by the upward sloping curve SEUlong run. Domestic short run supply is assumed much more inelastic, as illustrated by the vertical line SEU short runn. This is because it takes time for producers to adjust to a new price environment.

If a disruption occurs (some import is no longer available), the price for gas moves from p1 to p2 as illustrated in figure 2. The loss in consumer surplus of this price shock will be the area ADEG. Because of rigidities in the expansion of domestic production, EU suppliers will not be able to immediately increase production to C along their long-run supply curve. In the short run they will produce the same as before, qEUprod-1, but at the higher price p2, represented by point B rather than point F. They gain the area ABFG as a result of the increased prices. If they had been able to move to C, they would have gained ACFG, which is BCF greater than ABFG.

The area BDEF represents the net (short run) loss to society. DEJ is deadweight loss for consumers, and BDJF transfer of wealth from domestic consumers to foreign producers. In the longer run, if the new price level is sustained, domestic producers will adjust to C. Thus, the area BCOF is benefit for foreign producers in the short run and BCF for domestic producers in the longer run. In the long run foreign producers gain (only) CDJO, and lose areas FOLK and JENM, while CFO will be higher per unit costs due to higher domestic EU production. Therefore, a price shock causes larger economic damage in the short than in the long run. Consumers lose the area ADEG both in the short and long run.

Let us now assume that the imported quantity is viewed as a security problem, because of the losses in consumers' surplus when a disruption occurs. We assume that the problem is increasing in magnitude as quantity imported is increasing. One way to interpret the security problem connected with imported gas is that individual consumers, by buying gas and making investments and behavioral adjustments with the expectations that gas shall continue to flow at current prices, are imposing an externality to the society. They do not take into account the costs of increased stockpiling of various energies to counterbalance short run disruptions, the development and maintenance of emergency plans, domestic economic, political and external diplomatic efforts and possible military movements to secure supplies. Each of the consumers is too small to influence the overall outcome, and is better served by maximizing their own utility disregarding the externalities they cause.

The cost they impose on society is illustrated by the upward sloping marginal cost curve MCEUsecurity. As imports grow, the costs to society are increasing in order to minimize the likelihood of severe disruptions and to deal with the disruptions if they occur. EU welfare could be improved by changing consumption and domestic production decisions to reflect the total cost of gas imports, not just the private costs in market transactions.

With these external costs included, consumption should have been qEUsecurity, represented by point H where marginal social costs equal marginal benefits. In point E, which the market realizes, marginal benefits equal marginal private costs. At all consumption above qEUsecurity, marginal social costs exceed marginal benefits. Thus, the loss for overall EU economies by consuming qEUcons instead of qEUsecurity, is represented by the shaded triangle HIE.

If the price before a crisis occurs, by some means, is set to p3, consumers would lower demand from qEUcons to qEUsecurity and domestic producers would raise production from qEUprod-1 to qEUprod-2 after some time. At price = p1, the market has in fact realized a too high consumption and too low domestic production. The damage, if a disruption occurs, is reduced to an acceptable level at an acceptable cost by realizing consumption and import levels represented by point H instead of point E before it occurs.

To realize price p3 is however an intriguing question. However, the release of private stocks of gas could have the same effect. A stock release of quantity (qEUprod-2 - qEUprod-1) would be equivalent to a shift in the short run supply curve from SEUshort run-1 to SEUshort run-2. The question is, however, whether stocks can be large enough to cover this gap over the time period needed to increase domestic production. A stock release can only serve as a relief for a relatively shorter period of time. The loss for society will be large if EU relies only on stock policies to take care of the security problem without any adjustments in the magnitude of imports in case of long-lasting supply disruptions.

THE BENEFITS OF INCREASING NATURAL GAS CONSUMPTION

However, increased gas consumption and, hence, import is not followed by negative externalities only. Gas consumption also has an environmental advantage over oil, and even more over coal. This environmental advantage indicates that gas consumption should be increased compared to a level resulting from free market operations. This argument is reinforced by another security of supply aspect; in order to reduce dependency on (Middle East) oil; gas consumption must be increased.

Thus, the optimal price of gas should be lower than p1 when environmental concerns (and import dependency on oil) are taken into consideration (at price=p5). This is in contrast with the arguments we made that the optimal price of gas should be higher than p1 when import dependency on gas is considered.

OPTIMAL PRICING IN AN IMPORT DEPENDENT COUNTRY

In figure 4, private and social costs of security of supply and the social benefits of the environment and reduced oil dependence are taken together. For society, the optimal point of consumption and import will be where the marginal social cost (MSC) equals the marginal social benefits (MSB) of consumption; MCEUsecurity = DEUenvironment equal to MSCEUsocial = MSBEUsocial at point Q, realized in the market by price p6 at quantity q0. Whether gas consumption should be increased, maintained or decreased as compared to a situation where these externalities are disregarded is not possible to determine without detailed information on the type and degree of security problems and environmental and other social advantages.

Obviously, if q0=qEUprivate, nothing should be done. In this case, points Q and R are the same. If q0<qEUprivate a net positive tax could be introduced. In this case, the potential disruption costs are considered greater than the benefits of improved environment (and reduced oil dependency). If q0>qEUprivate a net subsidy to consumers could be given, or excise taxes on gas usage could be lowered as compared to taxes on the use of ether energy sources.

RELEASE OF SGRS TO MITIGATE PRICE SPIKES

The security problem for the EU can be considered along two dimensions. Firstly, to reduce the general level of dependency on imported gas. Secondly, at any given level of imports, to reduce the damage by a possible disruption in supply. Conservation and switching policies between energy carriers would be one contribution to improve the situation. Conservation and installation of equipment that rather easily can switch between fuels would make demand for gas more elastic and reduce the losses in consumers’ surplus in a crisis. Such policies would turn the MCEUsecurity curve around point F closer to the horizontal line represented by p1.

The discussion of figure 2 already mentioned that a release of stocks would mitigate prices during a crisis. Stock release represents an additional source of supply, and would lower the need for imports, and, hence, prices. Private stocks may, however, not be released in a crisis. Most businesses trading and/or refining commodities need inventories to meet temporary fluctuations in production and sales. The size of the inventory depends on ordered quantity and variations in supply and demand. In low-demand periods inventory is built up, and it is drawn down when demand is high. Increased variations in demand and/or supply as well as increased uncertainty increase the need for stocks.

In addition to such 'normal stocks' a firm can also build inventory for speculative purposes. This is not done from a need to fulfill delivery obligations, but to make profit on speculating on changes in price. Speculative inventory behavior implies that firms should build stocks when prices are rising, and sell when they are beginning to fall, corrected for the administrative and capital costs of keeping the stock. A speculative stockholder should build inventory when the difference between expected future prices and current prices exceeds the costs of storage. Thus, private stocks will most likely be built during a crisis, increasing demand and thus worsen the problem.

In order to increase supply in a crisis we need to introduce a strategic type of stocks, similar to the Strategic Petroleum Reserves (SPRs) for oil, owned by consuming countries' governments. Strategic gas reserves would be an additional source of gas supply in case of a crisis, which could dampen the rise in prices in the case of a disruption and shift in the short run market supply curve to the right (assuming EU is no longer only a price taker). The effect of the change in supply is lower import demand. If this shift is large enough, market (import) prices should be pushed down.

For SPRs (oil), Hubbard & Weiner (1982) and Austvik (1989) divide the effect of a stock release in four. The sum of these four effects gives the net result of a strategic stock release.

· The direct effect reduces demand for imports, and thus the magnitude of the spot (or short term) price changes. The mitigation of short-term price changes may also reflect some mitigation of future prices.The effect on market prices of a release of such strategic gas reserves depends, however, also how if affect private stocks. Let’s denote total stocks (S) as the sum of 'normal' private stocks (Sn); speculative private stocks (Ss) and the governmental owned strategic stocks / reserves (Sg).· The feedback effect represents the reduced cutback in consumption caused by a lower price than the market would have yielded without a stock release. Obviously, the feedback effect works against the direct effect.

· The international interaction effect depends on how foreign stocks react to strategic stock releases. If all countries cooperate, the strategic stocks in all countries are released simultaneously. This serves to magnify the effect. If not, competition implies that as some countries' stocks are built down, other countries' stocks may be built up, due to speculative purposes. This also serves to mitigate the direct effect.

· The domestic productions effect. Keeping down the prices implies reduced increase in domestic gas production compared to no intervention if high prices persist over a longer period of time.

(i) S = Sn + Ss + Sg

Consider a situation where prices rise rapidly and the government starts to draw on strategic reserves. The drawdown increases supply in the market and tends to dampen spot prices as well as the price volatility. Less price increase and volatility serves to lower both normal and speculative stocks. Thus, normal and speculative stocks will both increase less than with no strategic stock release. Thus, strategic stock releases serve to reduce private inventory accumulation and tend to lower total stocks more than just the reduction in the strategic stocks themselves.

Similarly, when these stocks are built, the partial effect on both private normal and speculative stocks is that they will be increased as well, because strategic stock build-up increases demand and, thus, prices. Therefore, strategic stock build up tends to increase total stocks more than just the build-up itself. Turning the sign; the sale of SGRs would encourage private speculators to sell inventories, and thus, magnify the effect.

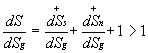

(ii)

However, reduced volatility in prices due to strategic stock releases does not necessarily manage to stabilize them totally. Therefore, when prices are increasing, speculative stocks may be built at the same time as strategic stocks are released. It may thus look like they absorb strategic stock releases because the net effect on prices is that they still are increasing. Furthermore, normal stocks will also increase at the same time, as strategic stocks are released, but less than with no intervention.

If we assume the shock is big enough so both normal and speculative stocks are built in a crisis even if strategic stocks are released and that they, thus, worsen the crisis, the question is whether the government can keep companies from making spot-market purchases in such a situation. Obviously, governmental interest in overall stability may in such a situation conflict with the companies' need for increased inventory to fulfill obligations as well as their speculative interests.

A successful strategic stock policy may improve the situation enough to take care of the externality posed on society for security of supply reasons. Increased flexibility for switching and conservation would further improve the situation by making demand for marginal gas more elastic during a crisis. The slope of the demand curve expresses some of this flexibility. If the government can order further reduction in gas demand and a change to other energy sources, the demand curve would make a shift to the left during a disruption and reduce imports further.

In figure 5, market supply is considered inelastic in the short run (S0) due to capacity restraints in production and pipelines, as one reason for a crisis to have dramatic price effects. Demand is drawn in D0 with initial market price p0. If some gas falls out of the market, supply is reduced from S0 to S1 and prices are shooting up to p1. Flexibility in switching makes it possible to shift demand curve to the left to D1 with a following price decrease to p2. The release of strategic stocks would push total market supply to the right as illustrated in S2 with the prices dropping to p3. By a combination of these two policies, the problem caused by the disruption is significantly reduced.

The question still remains, however, whether stocks can be built sufficiently large as compared to a possible disruption. In this context, the Groningen field, and perhaps other smaller domestic fields could be used for the purpose.

SGRS AS PART OF AN EU SECURITY-OF-SUPPLY STRATEGY

If a country becomes sensitive or vulnerable in its imports of gas, the imports (and consumption) have an added cost which is not reflected in the market place. As shown, a 'free' market generally results in too much dependence on imports. Self-sufficiency is, however, inefficient and the private costs of increasing domestic production to achieve self-sufficiency exceed social benefits. An embargo or a major disaster is not a certain event, it may not even occur. Thus, some imports are desirable. The optimal amount of imports will depend on the likelihood for a crisis to happen, the intensity and duration of the crisis and the ability to make policies to counteract the potential damages. The slope and shape of the marginal social cost curve for import dependency reflects this. For an overall assessment, however, these social costs must be balanced against the social benefits of consuming more gas due to environmental advantages of natural gas, reduced oil imports etc.

The security issue in the “old” European gas market is that, with its rather rigid structure, consuming countries could perceive the physical dependence on gas resources from a specific area to be a problem. In a liberalized market, where gas, at least theoretically, should flow freely across Europe, the price risk may become an additional concern. As removed institutional barriers for trade reduce the volume risk, the security of supply risk in the gas market may be more like in the oil market, where excessive pricing and ensuing stop-and-go policies is a major concern.

In a liberalized European gas market, prices will fluctuate more strongly and often than in the “old” more rigid market structure. A liberalized European gas market should increase flexibility compared to today's market in a way that customers, in principle, can buy gas from any source. If a disruption occurs in one place, another source can replace the disrupted gas more easily than today. Furthermore, perfect liberalization would lower consumer prices and increase consumption, which would benefit the environment.

These benefits must be weighed against the disadvantages caused by increased dependency on gas resources, much of them in remote, physical, economic and/or political difficult areas. In the European gas market large investments in gas production and transmission facilities may be delayed and, hence, increase the problem of secure supplies in the long run.

Present EU policies suggest that gas should be taxed more heavily, also relative to oil usage (EU 1997). It is argued for as a fiscal reform, but runs contrary to the environmental benefits of natural gas, increased gas usage and reduced oil imports. Rather natural gas should be taxed less than other energies. However, it fits with the desire to reduce imports in order to reduce dependence on foreign suppliers of gas. It would nevertheless only be by luck if the result is optimal when the different aspects are weighed together.

Obviously, regulation and market structures are not intended to maintain prices at heir former levels. A possible build up and later release of SGRs is meant to maintain minimum required levels of supply to the most critical markets and to eliminate excessive price spikes that would be damaging to the economy. Such spikes do not send appropriate price signals to domestic producers because they are typically not sustained long enough to justify long-term investments. However, they may cause sufficient injury to specific consumers to cause them to make sub-economic fuel conversion choices, relocate out of the country or shut down permanently. The SGR may also act as an insurance against a shock ever to happen: The expectation from the market (and political opportunists..) that these policies will be implemented in a crisis make it more difficult for prices actually to shoot up

Thus, the EU should continue developing a comprehensive energy strategy including security-of-supply considerations. In order to give producers a reason to invest to meet demand growth in the long-term, measures should be developed to mitigate price volatility resulting from a liberalized market, and allow prices to increase to appropriate levels to reflect long term market conditions and not only short and medium term conditions. In order to mitigate (short-term) problems in a crisis the building of strategic gas reserves should be considered, for example by developing the Groningen field and other older fields as such.

References:

Austvik, Ole Gunnar, 1989: Strategies for Reducing U.S. Oil Dependency, Department of Economics Harvard University Spring 1989; NUPI-report no. 130 July 1989. 58 pages. ISSN no.0800-0018.

---, 2003: Norwegian Natural Gas; Liberalization of the European Gas Market. Europa-programmet February. ISBN 82-91165-30-0. 272 pages.

European Union, 1997: Restucturing the Community Framework for the Taxation of Energy Products, Proposal for a Council Directive COM (97) 30 Final 97/0111 (CNS) 12.3.1997.

---, 2002:The internal market in energy: Coordinated measures on the security of energy supply, Proposal for Directive, Brussels 11.9.2202 COM(2002) 488 final.

Hogan W.H. & Mossavar-Rahmani B., 1987: Energy Security Revisited. Harvard International Energy Studies no. 2. Energy and Environmental Policy Center, John F. Kennedy School of Government, Harvard University.

Hubbard, R.G & Weiner, R, 1982; The 'Sub-Trigger' Crisis: An Economic Analysis of Flexible Stock Policies, Discussion Paper H82-07. Energy and Environmental Policy Center, Kennedy School of Government, Harvard University.

Keohane, R.O. & Nye J.S., 1977: Power and Interdependence; World Politics in Transition. Little & Brown.

.