Ole Gunnar Austvik: Ole Gunnar Austvik: Oil Prices and the Dollar Dilemma: Exchange Rate Fluctuations as a Source of Disequilibrium in the Crude Oil Market OPEC Review, no. 4 December 1987 pp.399-412. Winter 1987. ISSN no. 0277-0180 Find the article at the publisher site here: Download the article as pdf-file. |

Summary:

When the exchange rate of the U.S. dollar

fluctuates, a disequilibrium is created in the market for crude oil.

This

will be reflected in altered demand for crude oil and/or in an altered

oil prices. The partial equilibrium model in this paper illustrates

that

an appreciation of the dollar leads to a lower oil price denominated in

dollars. The effect will be smaller the greater the U.S.'s share of the

oil market, the more elastic demand is in the U.S. and the more

inelastic

demand is in other countries.

Introduction

This paper addresses the impact of changes in exchange rates of the U.S. dollar on the oil market. The discussion relies on a partial equilibrium model to illustrate how disequilibrium in the oil market occurs, and how a new equilibrium may be reached, when dollar exchange rates fluctuate.

Oil prices are influenced by a number of economic, political and psychological factors. In order to determine how exchange rates make an impact, it is useful to rely upon a model based on partial analysis. This method enables us to examine the impact of exchange rate fluctuations on oil prices independently from other variables. Thus, in the model presented in this paper we exclude variables such as how fluctuations in the exchange rates affect macroeconomic conditions and subsequently the demand for oil, effects of the substitution of other energy sources either globally or regionally, the fact that a number of countries have large debts and assets held in dollars, the fiscal policy each country applies to changes in currency rates, and other economic and political factors than exchange rates which have an impact on the level and structure of demand, supply and the price of crude oil. From our analyzes we also exclude repercutions back to the currency markets from changes in oil prices.

The development of oil prices in different currencies in recent years is described in Section 1. In particular, this discussion focuses on the differences between oil price denominated in European currencies as opposed to the oil price in terms of U.S.dollars. In Section 2, a partial equilibrium model of the oil market is introduced to illustrate how oil prices both in U.S. dollars and other currencies, react to fluctuations in exchange rates. Some concluding comments are made in Section 3.

1. The U.S. Dollar and the Market for Crude Oil

Most primary commodities are priced in American dollars. Trade, however, goes to a large extent between countries that do not have the dollar as their national currency. Thus, the U.S. dollar is a common converting unit for all actors in the market. However, the price faced by each buyer and seller in the market is the price of the commodity determined in dollars multiplied by the country's exchange rate against the U.S. dollar (number of units of national currency needed to buy one U.S. dollar).

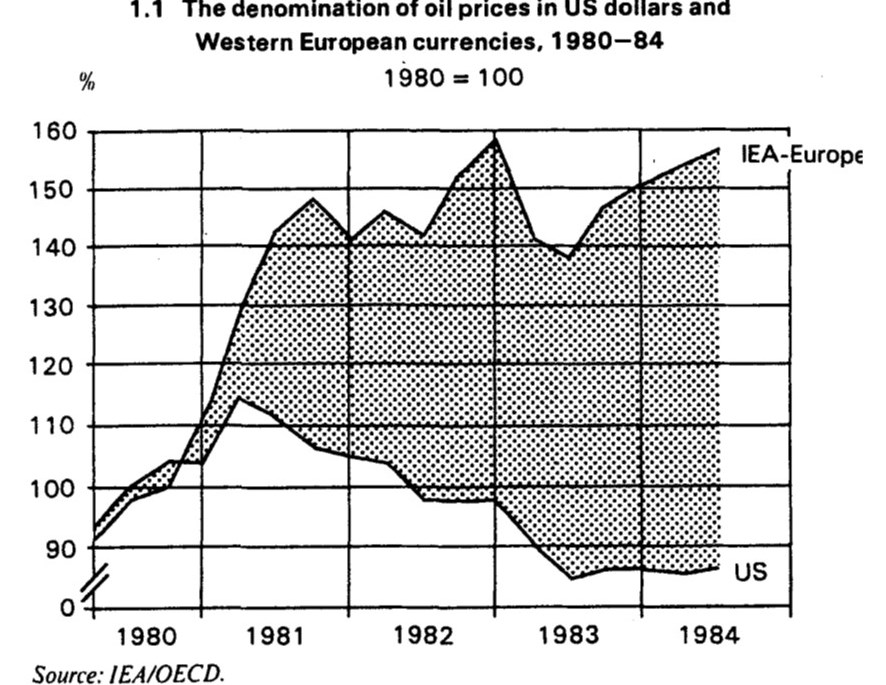

In the first half of the 1980's, the dollar

price

of oil decreased. However, the rise in the value of the dollar against

most other currencies led to an increase in oil prices in most other

currencies.

Depending on the degree to which each national currency was depreciated

against the U.S. dollar, the developments in the oil prices differed

remarkably.

In Western Europe, oil prices increased by approximately 50 per cent in

the period 1980-1984. At the same time, prices in U.S. dollars

decreased

in

the range of 15 to 20 per cent. Thus, European oil prices increased

more

than 70 per cent in relation to prices in U.S. currency in this period.

This development is shown in figure 1.1:

To take a closer look at some of these

problems

we shall consider a partial equilibrium model illustrating the

relationship

between fluctuations in the currency market on oil prices.

2. Crude Oil Prices in Purchasing Countries with Different National Currencies

Our world consist in the model of only two countries, Country A and Country B; the U.S. is Country B and "rest of the world" is Country A. The demand for crude oil in each country (qi, i = A and B) can be expressed as a function of the price (pi) denominated in their respective national currencies.

qA = f(pA), where f' < 0

qB = g(pB), where g' < 0

The demand for crude oil is assumed to fall with increasing price. For any given price the demand in each country is determined:

For country A the demand curve will be the aggregate of each of the individual countries in the "rest of the world"'s national demand curves for crude oil.

The difference between the two countries' national prices is represented by the exchange rate between their currencies:

pA = VA * pB

VA is the number of units of Country A's

currency

per unit of Country B's currency (i.e. the number of German marks pr.

U.S.

dollar). The price of crude oil in Country A's currency fluctuates

according

to changes in the currency rate, at a given price of oil in Country B's

currency. Thus, the relationship between the two oil prices can be

expressed

as a ray from the origin with the two oil prices on the axes. The

initial

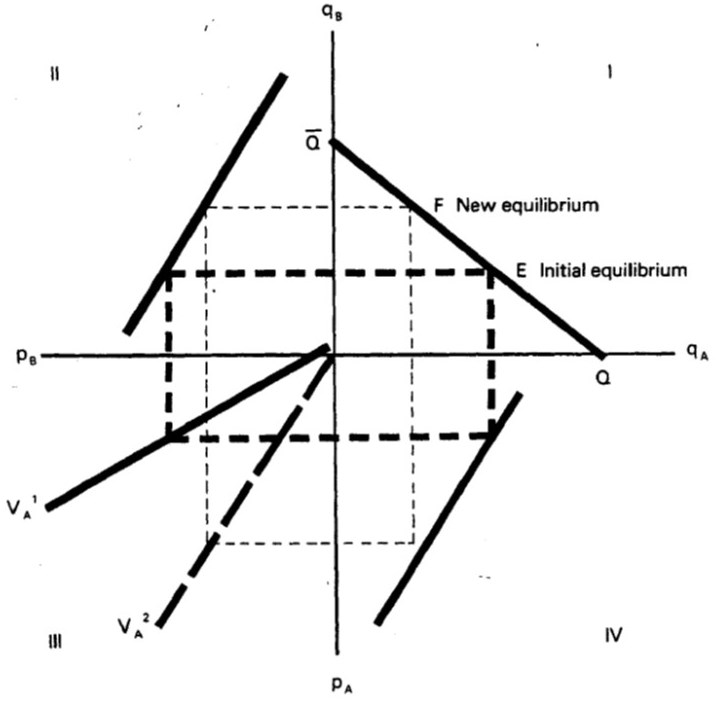

rate is illustrated in the figure below by the slope of the ray VA1.

For

any price in Country B's currency, there is a corresponding price in

Country

A's currency. The difference results from the exchange rate.

If the currency of Country B is appreciated, Country A has to pay more units of its national currency per unit of Country B's currency, and the slope of the ray will change from VA1 to VA2. Now Country A has to pay more per barrel of oil than before, at a given price of oil determined in Country B's currency, pB (U.S. dollars). In the figure above this is expressed by an upward turn of the ray, and oil prices in Country A's currency will change from PA1 to PA2, where PA2 > PA1. The currency of Country A is then de facto devaluated; either through an administered devaluation of the currency in Country A, an administered appreciation of the currency in Country B, or a change in the exchange rate between the currencies caused by other forces in the market.

We assume that the actual purchase of oil by

the

two countries equals the total supply of oil, Q. Thus, the total supply

of oil is given in this model.

_

qA + qB = Q

Graphically this equation can be illuminated

as

in the figure below:

The supply is assumed to be totally inelastic and will not be influenced by changes in the price. Thus, in our partial equilibrium model, a certain level of demand in the one country directly determines the demand in the other. This is, of course, a simplification done because it is useful for analyzing the problem at hand. However, to include supply changes in this pure economic model we would have to assume that, in one way or another, the supply side would react unique to price changes. Experts disagree how oil supply reacts to changes in oil prices. Some experts even claims that prices are only a minor factor in the determination of crude oil supply; it is political factors that determine the supply of crude oil. Thus, as a pure price-quantity scheme seems to be too unsure and/or too simple to describe supply side behavior, we exclude this discussion by considering supply exogenously in our model. However, we shall discuss some effects on our results if we modify this assumption in Section 3.

The equations we have provided outline (1) how demand for oil in each Country varies with respect to national prices, (2) the relationship between national prices and (3) that total consumption equals total supply:

2.4 Analytical Model for Oil Prices and Exchange Rates

The system consists of 4 equations and 6

variables

(pA, pB, qA, QB, VA and Q). We assume Q to be exogenously determined in

the model (the supply is kept constant), thus changes in the system are

dependent upon the determination of the exchange rate.

Differentiating 2.4.1-4 gives:

2.4.5 dqA = f' * dpA where f' < 0

2.4.6 dqB = g' * dpB where g' < 0

2.4.7 dpA = VA * dpB + pB * dVA

2.4.8 dqA + dqB = 0

Reorganizing 2.4.5-8 gives the following results

from altering the exchange rate (appreciating the dollar):

The price of crude in Country A increases ; An appreciation of the dollar results in an increase in oil prices outside of the U.S.

The increase in price in Country A implies

a decrease in demand in that country. An appreciation of the dollar in

relation to other oil importers currencies cause for an decrease in oil

demand outside of the U.S.

An equilibrium in our model implies a decrease in Country B's price. An appreciation of the dollar in relation to other oil importers currencies causes the crude oil price in dollars to decrease.

The demand for oil in Country B increases.

An appreciation of the dollar towards other oil importers currencies

causes

the demand for oil in U.S. to increase.

Graphically 2.4.1-4 can be illustrated as in the figure below:

In the first quadrant we illustrate the distribution of total supply of crude oil (2.3), in the second quadrant the demand for crude oil in Country B, in the fourth quadrant demand for oil in Country A (both 2.1) and in the third quadrant the rays VAi (i=1,2) illustrate the relationship between the prices in the two countries (2.2) with two different exchange rates between them.

Initially equilibrium is at point E, where demand is distributed between the countries at the prevailing prices and exchange rates. This initial equilibrium is illustrated by the thicker broken lines.

If the currency of Country A de facto is devaluated, the relationship between the national oil prices is affected. This is expressed by a turn of the ray from VA1 to VA2 in the third quadrant.

After the devaluation the initial distribution of crude oil no longer represents an equilibrium since it is not consistent with the new relationship between the prices in the two countries. The new equilibrium is at point F, where the oil price in Country A has increased. This implies that demand decreases in that country. Accordingly, the price in Country B has decreased, as the demand for oil in country A has increased. Thus, a switch in oil consumption from Country A in favour of Country B has taken place.

In this model the quantity effects of a

devaluation

will be of the same size in both countries, with opposite signs. The

decline

in consumption in one country, will be met by a correDette var

skrifttype/pitch

1,10 - Av.Dette var skrifttype/pitch 1,10 - På.sponding rise in

consumption

in the other country. Thus, the numerical value of the elasticity of

demand

in each of the countries with respect to the exchange rate can be

expressed

as:

This elasticity give an expression of how

many per cent qi will change when VA changes 1 per cent. It illustrates

that a low numerical value of the demand derivatives with respect to

prices,

f' and g', also correspond to low numerical value of the demand

elasticity

with respect to exchange rates. Since demand elasticities have the same

sign as the corresponding demand derivatives but give an expression of

relative as apposed to absolute changes, we can conclude from this that

the transfer effect in quantity of a devaluation of one of the

currencies

is less the more inelastic the demand is with respect to national

prices.

The demand elasticity with respect to prices in one of the countries

will

(in this model) have an equally strong impact on the demand in the

other

country as the demand elasticities (with respect to prices) in the

country

itself.

However, an appreciation of the dollar will not necessarily result in a total redistribution of volume of oil between U.S. and other importing countries. Because of a rigid production structure and other features unique to the U.S., there will be some limitations on how much oil the nation can absorb in the short run, independent of price. In addition to the downward pressure on the dollar price of oil in the adjustment towards a new equilibrium, an appreciation of the dollar would probably result in decreasing the total quantity demanded as well.

The elasticities of the national prices with respect to the exchange rate between the two countries' currencies can be expressed as:

The equations 2.4.9 and 2.4.11, respectively,

provide us with the sign of the above equations for each country. From

these, we can see that the differences in the numerical value of the

two

countries' derivatives of prices with respect to exchange rates is the

numerical value of the demand derivatives with respect to prices, f'

and

g'. In relative terms, this implies that the difference between the

numerical

value of the elasticities of national oil prices with respect to the

exchange

rate is also is the numerical value of f' and g':

This means that the elasticities of prices

with respect to the exchange rate depends on the elasticity of demand

in

each of the countries with respect to national oil prices. This implies

that the changes in oil prices in the devaluating country will be

larger

the more inelastic demand is with respect to prices in that country.

The

effect will be smaller the more inelastic demand is with respect to

prices

in the other country.

Thus, an appreciation of the dollar leads to a smaller price decrease for oil denominated in dollars the more elastic demand is in the U.S. and the more inelastic demand is in other oil importing countries. The more elastic demand is in the United States relative to the demand in other importing countries, the less the dollar price will be pushed downward and vice versa.

Experts do not always agree whether production of oil will rise or fall with increasing oil prices. The picture becomes even more complex when also political factors are added. In the model, we have assumed that supply is kept constant; i.e. that supply is exogenously determined. However, if i.e. supply increases with increasing prices, an appreciation of country B's currency will lead to decreased production of oil in that country, and an increased production of oil in Country A. Total world oil supplies will increase, remain the same or decrease depending on if the elasticities of supplies with respect to prices multiplied with each country's crude oil production are larger, equivalent or smaller in Country A than in Country B. Thus, an appreciation of the dollar would normally lead to an increase in world oil production, as supply to the world oil market is much larger from outside than from inside the U.S.. If supply reacts negatively to price increases (backward bending supply curve), the equivalent arguments can be done, with the signs reversed. To say more precisely how total supply will react to exchange rate fluctuations one would have to include more comprehensive models for the crude oil market, which in their turn would require precise presumptions about the frames for and rules of the market, both in the economic and political sense.

The decrease in total demand and probable increase in total supply resulting from the appreciation of the dollar, creates in and of itself an imbalance in the market. This results in further downward pressures on oil prices denominated in dollars.

The U.S. share of the oil market will also be

one of the factors determining to which degree changes in the value of

the dollar have an impact on oil prices. If the U.S. has a small market

share the dollar is less representative for denominating the oil prices

than if they have a larger share of the market. The dollar price will

have

to change more to balance an imbalance in the market the smaller the

U.S.

share of the world oil market, and the entire system will be more

volatile.

3. Closing Comments

Depending on the development in the currency markets nations can face different prices for oil, with demand and supply conditions held constant. The model presented in this paper illustrates that an increase in the exchange rate of the dollar against other currencies (as in the first half of the 1980's) leads to a lower oil price in dollars, a higher demand for crude oil in the United States and a lower demand for crude oil in the rest of the world. If, on the other hand, the exchange rate of the dollar depreciates (as in the 1970's), the oil price denominated in dollars increases, the demand for crude oil in the United States decreases and the demand for crude oil in the rest of the world increases. Since there seems likely to believe that there are some time lags between exchange rate fluctuations and crude oil market reactions, the model may be viewed as an illustration of a long-run equilibrium in the crude oil market.

Thus, as a result of the steadily increasing exchange rate of the American dollar in the first half of the 1980's, oil prices for most countries increased rather than decreased. Since OPEC reduced their output in the period simultaneously, one could say that they have followed a relatively aggressive pricing policy in the first half of the 1980's. The strategy of decreasing supply to keep oil prices in dollars up, has, together with lower economic growth rate, contributed to the sharp decrease in oil consumption.

In 1987, the continued decline in the value of the U.S. dollar, contributes on the other hand to an increase in demand for oil outside the U.S.. This is in addition to the increased demand initiated by the lower dollar oil prices and otherwise increased economic activity. If the decline in the value of the dollar continues its trend in the years to come, one could expect stronger price increases in terms of dollars, as compared to projections based solely on the development of demand and the utilization of capacity in the OPEC countries alone.

Thus, developments in the currency market

represent

a factor of uncertainty in prognoses of future oil prices denominated

in

dollars. The divergent development of oil prices contributes to

different

regional growth rates, and thus to different patterns in the demand for

oil, as well. Accordingly, projections of future demand for oil have to

incorporate considerations about possible developments in currency

markets.

If one, for example, uses only U.S. dollars as a measurement of the

development

of oil prices, the consumer's total reaction to

changes in prices might well be over- or

underestimated.

References:

Amuzegar, Jahangir, July 1978: OPEC and the Dollar Dilemma, Foreign Affairs.

Austvik, Ole Gunnar, March 1986: Søkelys på mekanismene i oljemarkedet, NUPI-report no.97, Oslo.

British Petroleum, 1986: BP Statistical Review of Energy, London.

Brown & Philips, July 1984: The Effects of

Oil Prices an Exchange Rates and World Oil Consumption, Economic

Review,

Federal Reserve Bank of Dallas, Texas; March 1986: Exchange Rates and

World

Oil Prices, Economic Review, Federal Reserve Bank of

Dallas, Texas.

Dailami, Mansoor, 1979: Inflation, Dollar Depreciation and OPEC's Purchasing Power, Journal of Energy and Development.

Fleisig & Wijnbergen, 1985: Primary Commodity Prices, The Business Cycle and the Real Exchange Rate of the Dollar, World Bank, Washington.

Henderson & Quant, 1971: Microeconomic Theory, McGraw Hill Kogakusha.

Huntington, Hillard G., 1984: Real Oil Prices from 1980 to 1982, The Energy Journal Vol.5 no 3, IAEE; August 1986. The Dollar and the World Oil Market, Energy Policy, London.

IEA/OECD, Different Issues: Quarterly Oil Statistics, Paris.

Ridler & Yandle, 1985: A Simplified Method for Analyzing the Effects of Exchange Rate Changes on Exports of a Primary Commodity, IMF Staff Papers, Washington.

Shaaf, Muhammed, 1985: Strong Dollar, Low Inflation and OPEC's Terms of Trade, Journal of Energy and Development.

Sødersten, Bo, 1978: Internationell ekonomi, Rabén & Sjøgren, Stockholm 1978

A.1: Can Oil Be Priced In Currencies Other Than the U.S. Dollars ?

For most countries, the real price of oil is dependent on two main factors: the value of the dollar vis-à-vis other main currencies and the rate of inflation. Since oil prices are contracted in U.S. dollars and the oil exporters import their goods from countries in addition to the United States, a strong dollar will increase the real price of oil and a weak dollar will decrease it. A decrease in the value of the dollar will weaken an oil exporter's purchasing power since it effectively makes imports originating outside the U.S., calculated in barrels, more expensive. However, the decrease will make oil cheaper in countries outside the U.S. and thus initiate an increased demand in those countries. The degree of changes in real values varies according to which trading partners the oil-exporting country has, and the development of these countries' currencies against the dollar. If i.e. the value of the dollar increases substantially relative to the EC currencies (as in the first years of the 1980's), and the oil-exporting country receives most of its imports from the Community, the purchasing power of the oil exporting country will increase given a certain dollar price of oil. Accordingly, the EC countries will pay more for their oil imports in national currencies. Because of the volatility in the oil-exporting countries incomes and the importers' expenses suggestions have, from time to time, been suggested that oil should be priced in other currencies than the dollar. The problem is, however, that normally the exporters and importers have different interests in when crude oil should be priced in other currencies. When the value of the dollar increases (as in the 1980's), the exporters gain while importers lose by pricing oil in dollars. If the value of the dollar deteriorates (as in the 1970's), exporters lose while importers gain by pricing crude oil in dollars. However, a price calculated in some or other currency basket would show a more stable development, and could be used for more continuous revision of production and consumption than results from the adjustment shocks experienced from one time to another by the oil market.

In addition to the volatility caused by fluctuating exchange rates, a number of oil exporting countries have large assets in dollars and some have large debts. Fluctuations in exchange rates strongly influence each country's standard of living. Exchange rate developments contribute to the countries' relative economic strength and become an important policy target both for the countries receiving a lot of their income from crude oil and/or those that have large assets in dollars. Accordingly, but with the sign reversed, the same is valid for countries with large import bills in dollars and/or debt in dollars.

Early in the 1970's, when the dollar was weak, the multinational oil companies agreed to adjust the price of oil in line with the development in the currency markets, based on a basket of currencies. Various baskets have been advocated since that time, and we shall mention a few of them.

A.1.1 Currency Basket 1: Geneva I

The first currency basket agreed upon by OPEC and the multinationals to adjust the dollar price according to the relative depreciation of the dollar vis-à-vis a currency basket was named Geneva I. This basket was the arithmetic average of 9 currencies; the Belgian, Swiss and French francs, German mark, Italian lira, Japanese yen, Dutch gulden, Swedish krone and pound sterling.

A.1.2 Currency Basket 2: Geneva II

In 1973, the OPEC countries decided to negotiate with the oil companies to adjust the Geneva I agreement. In the Geneva II agreement they agreed to use the arithmetic average of 11 currencies' exchange rates vis-à-vis the dollar as the reference for correction of the dollar price. The 11 currencies were the same as those in the Geneva I agreement plus the Canadian and Australian dollars.

A.1.3 Currency Basket 3: Special Drawing Rights (SDR)

The use of the International Monetary Fund's (IMF) Special Drawing Rights (SDR) instead of American dollars in the pricing of oil has also been advocated. The SDR was originally designed with 16 currencies in 1974, but in 1981 it consisted of only 5: the U.S. dollars (42 per cent), German mark (19 per cent), French franc, Japanese yen and pound sterling (each 13 per cent). The weight of each country's currency was based on its share of world trade.

A.1.4 Currency Basket 4: Trade basket

A basket of currencies composed according to the OPEC countries' foreign trade could give rise to disparities between the individual countries, as they diverge significantly in their trading patterns. If one uses total import figures for all OPEC countries and gives each of the countries weight according to their individual share of total imports, the following 9 currencies would be considered: U.S. dollar, Japanese yen, Belgian franc, German mark, French franc, Italian lira, Dutch gulden, pound sterling and Danish krone.

Closing Comments

Today it does not seem realistic to believe that the participants in the market could agree to price oil in any currency other than the dollar. Thus, the various currency baskets mentioned above might be used to adjust the dollar price of oil according to the situation on the international currency markets as well as on other considerations. This would make a contribution to the stability in the incomes for most oil exporters determined in terms of each country's imports. Given the development of the value of the dollar since the breakdown of the Bretton Woods system at the beginning of the 1970's, continuous revision might imply greater fluctuations in nominal dollar prices. Such fluctuations would in themselves probably be judged negatively in the U.S. and in those exporting countries which import goods and services in large quantities from the U.S., but alternatively they would on the other hand be reviewed as an advantage for most other exporters and importers.