|

EU Natural

Gas Market Liberalization

In Gunnar Ferman (ed): The Political Economy of Energy in Europe: Forces of Integration and Fragmentation. Berlin: Berliner Wissenshafts Verlag GmbH October 2009. ISBN 978-3-8305-1635-4. pp. 85-118. Search details inside the book: Amazon.de. Download the article as pdf-file

|

First, a discussion of the geopolitics of natural gas and what security-of-supply for importing countries, as well as an equivalent term for security-of-demand for exporting countries, is put forward. Second, impacts from market liberalization depending on status and maturity of the market are assessed. Third, economic theory of exhaustible resources is used; a) to discuss effects of competition among producers on short- and long-term supply and prices; b) to analyze impacts from downstream market liberalization on long-term production investments; and c) to discuss the political uncertainty about ex post higher natural gas usage taxes on producers’ investment decisions. Next, neofunctionalist and intergovernmentalist views on EU integration processes are contrasted so as to understand to what extent the EU as a decision making institution, or the member states, will be most decisive in determining natural gas policy in the Community. Finally, impacts from long-term supply security concerns on scope, opportunities for and limits to a furthered politically-led EU gas market liberalization process are put forward.

Keywords: European Union, gas market liberalization, energy security.

This web-version of the article may contain inaccuracies.

Please use the printed

version for proper reference.

1. Introduction

Political decisions at the European Union level and in EU member states have, together with market growth and new transmission and storage capacities, contributed to the development of a more open and flexible EU natural gas market. However, the market is still far from being fully liberalized (EU 2007a; Correlj?, van der Linde, T?njes and de Jong 2006). The fact that natural gas is traded outside the EU, the non-renewable character of natural gas resources and the non-competitive nature of natural gas markets appear as obstacles for a liberalization process to follow a straightforward microeconomics textbook design. Over the past few years, the limited number of locations of petroleum resources and their exhaustible nature has, together with high economic growth especially in emerging Asian economies, resulted in tight energy markets and high prices. They have reminded consuming countries of the scarce character of the resources and brought the issue of security-of-supply high up on the political agenda. The high prices and the strategic importance of energy in economic and political affairs have raised questions about how the liberalization of energy markets may increase economic efficiency, and thus stimulate growth, when at the same time energy security needs to be taken into consideration (Stern 2002; EU 2006; Finon and Locatelli 2007).

Concerns over energy security are not novel. This means securing supplies for import dependent countries as well as stable outlets for exporting countries investing heavily in the extraction and export of energy. In fact, it has been a political preoccupation ever since coal, oil and gas became drivers for industrialization and preconditions for modern society. Over the past few decades the issue of energy security became particularly clear during the oil crisis in 1973-74 for countries in the West, when Arab members of the Organization of Petroleum Exporting Countries (OPEC) used oil as a political weapon against those having supported Israel in the 1973 Arab-Israeli War. As a direct result from this crisis the International Energy Agency (IEA) was created on the Western side. More recently, in 2006-07, the Ukrainian government claimed that Gazprom’s decision to limit gas exports to Ukraine was part of a Russian strategy to interfere in Ukrainian politics. Regardless of how one considers the political motivations and results of the respective oil and gas crises, the actions of the exporting countries were instrumental to increasing the price of energy, and thus the revenues from energy exports. In flexing their muscles, both OPEC and Russia managed to bring about a redistribution of wealth from energy importing to energy exporting states.

However, energy security should not be considered as a political issue only. It is also an economic challenge. The non-renewable nature of a petroleum resource implies that the more you take out of the reserves, the less is left for future production. Even if politics were disregarded totally, the long term security-of-supply question remains whether enough supply can be provided to meet an ever expanding demand. Although there are substantial disagreements about when oil and gas production eventually will peak,2 at some point in time other sources of energy must be phased strongly into the energy demand portfolio, and energy efficiency measures become paramount to balance the inability to provide sufficient non-renewable petroleum resources.

The main task of this chapter is to shed light on the intentional and functional linkages between EU natural gas market liberalization and long-term energy security. In particular, how will the continuing liberalization efforts by the EU affect long-term security-of-supply for natural gas? How is EU energy security linked to the issue of security-of-demand for exporting countries? How do the concerns for long-term energy supply influence the process, strength and direction of EU’s common energy policies?

First, a discussion of the geopolitics of natural gas and what security-of-supply for importing countries, as well as an equivalent term for security-of-demand for exporting countries, is put forward. Second, the relation between market maturity and effects of market liberalization are outlined. Third, the economic theory of exhaustible resources is used; a) to focus on effects of competition among producers on short and long-term supply and prices; b) to analyze the impacts from downstream EU market liberalization on long-term production investments; and c) to discuss the political uncertainty about ex post higher natural gas usage taxes on producers’ investment decisions. Next, neofunctionalist and intergovernmentalist views on EU integration processes are contrasted so as to understand to what extent the EU as a decision making institution, or the member states, will be most decisive in determining natural gas policy in the Community. Finally, impacts from long-term supply security concerns on scope, opportunities and obstacles for a furthered politically-led EU gas market liberalization process are put forward.3

2. Geopolitics of natural gas: Security-of-supply and security-of-demand

As a critical and fast growing source of energy, natural gas is important for the security-of-energy-supply and the economic development in the EU. Similarly, for countries exporting to this market, the costs and revenues are significant for their welfare. The substantial European gas trade has grown rapidly since the 1970s which has created interdependence between exporting and importing countries. Both can become sensitive and vulnerable to changes in prices, supply and market access, respectively. Expensive pipelines link buyers, transmitters and sellers in different countries tightly together on a long-term basis, making European gas trade relevant also for bilateral and multilateral European and international affairs. The more imperfect markets are, the more important the behaviour of the participants is, being political, regulative or commercial. Social first-best solutions as defined in economics may not be attainable in such markets, and policy choices must be found among several alternative second- or third-best alternatives. In markets for non-renewable resources this could be said to be a new form of energy geopolitics.4 The long-term bindings in the European natural gas markets, caused by the huge sunken costs especially in pipeline infrastructure, represent an additional challenge compared to supply and demand security problems in the oil market, where parties can change constellations more rapidly.

Problems and risks of security-of-supply for natural gas importers and security-ofdemand for exporters are linked to degree and type of dependency on the other. The IEA (1995:17) has set out two broad categories for gas security risks for natural gas importing countries:

“Long term risk that new supplies cannot be brought on stream to meet growing demandRisks are connected to “threats of supply and price disruptions arising from risks associated with the sources of gas supplies, the transit of gas supplies and the facilities through which gas is delivered” (Stern 2002:6). The operational dimension is to handle variations in demand, commercial storage etc. The political, or strategic, dimension is linked to the possibility of major breakdowns in production or infrastructure being political or non-political. As gas is a non-renewable resource, long-term supply risk is concerned with investments in new field developments at least to replace decline in old fields, but rather to increase production sufficiently to meet expected demand growth. Producers are similarly concerned with security-of-demand for gas in terms of market access and price disruptions (a dramatic price drop in their case), transit issues and the functioning of upstream and downstream infrastructural facilities.

for either economic or political reasons;Risk of disruptions to existing supplies such as political disruptions, accidents or extreme

weather conditions”

The potential risk faced by both importers and exporters results from the interdependence created by increasingly more international trade. This interdependence, however, is not always problematic. For a consuming country import dependency has been defined as a situation where it does not possess the capacity to produce 100 % of its own needs (Hogan and Mossavar-Rahmani 1987:8). A similar definition for a producing country would be a situation where it does not have domestic customers with the capacity of consuming 100 % of its production. According to such definitions most countries are dependent on imports of a whole range of commodities, and on exports of fewer commodities (because countries specialize) to pay for the imports. Dependency on exporting and importing goods and services to and from other countries is the normal state of affairs in a modern society, and a consequence of increased economic integration.

The political concern arises when the dependency causes short or long-term problems when prices, supply or market access changes significantly. An importing country can be somewhere in the continuum between neutral, sensitive or vulnerable in its dependency on a commodity when its price or availability changes. An exporting country is similarly concerned about the change in price and market access. The character of the dependency a country is facing will be a function of the magnitude and duration of change, the country‘s ability to adjust to it, and the importance of the commodity in the economy. The dependence between sellers and buyers is reciprocal but not necessarily symmetrical, and the balance may change over time.

Neutral dependence we define as a situation when a country exports or imports a commodity, and always has an alternative if one of the customers or suppliers disappears. This is a situation that is very equivalent to what is assumed in contestable markets; there are numerous suppliers and customers and none of them has any influence on market outcome. If one supplier or customer, respectively, withdraws from a relationship there will always be someone in the market to fill the empty place. In such a situation, there should be no concern over supply or demand security.

Supply and demand problems arise when markets are imperfect; when sellers and buyers to some degree are locked-in with each other. A change in price or availability then leads to changes in costs (or revenues for exporters), and/or access to the commodity (or markets) and the response must be to adjust to the new situation rather than just change to another seller (or buyer). Sensitivity dependence is in this context measured by the degree of responsiveness within an existing policy framework. It may reflect the difficulty to change policy within a short time and/or bindings to domestic or international rules, when price or availability /market access change dramatically. Vulnerability dependence is more serious and measures the ability to adjust to changes after policies have been changed (Keohane and Nye 1977:12-18).

In economic terms, vulnerability dependence can be represented by the potential for significant losses of output or welfare. Sensitivity dependence, on the other hand, does not need to induce a welfare loss in the long-term when circumstances change. Vulnerability dependence is primarily concerning long-term supply and demand issues, while sensitivity dependency to a greater extent concerns the risk of disruptions to existing supplies. Sensitivity dependence occurs in the short term or when normative constraints are high and international rules are binding“. A vulnerability dependence occurs when normative constraints are low, and international rules are not considered binding“ (ibid). Thus, a country‘s vulnerability dependence can be significantly different from its sensitivity dependence, and potentially much more costly.

The costs of dependency on imports of a commodity can be measured both by increased expenditures as well as the effects of changes on societies and governments due to higher prices and/or more difficult access to the commodity. The cost of dependency on exports of a single commodity can similarly be measured by changes on society due to a sharp drop (for many petroleum exporting countries also even a sharp rise) in prices and/or more difficult access to markets. As dependency on imports and exports is a normal state of economic affairs, government policy should aim at eliminating or reducing (potential) sensitivity and vulnerability dependence, while neutral dependency from this perspective is optimal.

Policy response depends on political will and ability, resource capabilities as well as on the rules of conduct embedded in international regimes (e.g. WTO regulations, EU law). The challenge is both of an external and domestic political nature. An importing country can become more sensitive or vulnerable in a given state of dependency if the commodity originates from one powerful state, as opposed to if it is multilaterally dependent. An exporting country can become more sensitive or vulnerable if it depends only on one market as opposed to many markets in its exports. It is important whether supplying, respectively purchasing, nations are antagonistic or friendly in their relations in addition to the degree of market power they possess. Foreign policy will consequently be an important external instrument for reducing sensitivity and vulnerability dependence, in addition to influencing degrees of market imperfections that may exist.

For a natural gas market liberalization process within the EU it is only in a situation where the EU is permanently (commercial and political) neutral dependent on imports and transit of the non-renewable resource, or is sufficiently flexible to change to affluent supplies of alternative sources of energy, that international affairs and market organization is not to be considered important for its long-term success. However, these conditions are not fulfilled: natural gas is a non-renewable resource. It has a limited number of supplying nations and companies dominating external supply, relatively few transit lines and close to all growth in consumption must be imported, it is difficult to see that the EU is not potentially sensitive, if not vulnerable in given situations, to changes in supplies and prices. In an extreme and perhaps hypothetical scenario where most Russian (or even Norwegian) gas disappears from the market, EU dependency may possibly be characterized as vulnerable. More realistically, however, with a more nationally defined petroleum policy in Russia over the last years it is not certain that growth in Russian supply will follow desired growth in imports as defined by the EU. Russia, Central Asian and Persian Gulf countries together represent some 2/3 of world proven natural gas reserves. These countries can over time chose to send gas to the East or to the West, contributing to making Europe and Asia increasingly compete for resources in order to enhance their own security-of-demand.5 The long-term risk for European gas importers is that enough new supplies cannot be brought on stream to meet demand. This risk can emanate both from external political problems as well as from the non-renewable and scarce nature of the resources.

External market and political situations and relations are important for what kind of commercial and political opportunities and challenges evolve for EU actors, as well as what intra-EU measures can be expected to be sustainable. The mirror image for exporting countries is that they depend on the EU as the major buyer largely dominated by few companies as commercial actors and on a gradually stronger coordination of policies at the EU level relevant for energy and natural gas markets. Without proper security-of-demand, large and long-term investments in natural gas production and infrastructure cannot be sustained, and will influence exporters’ room for maneuver.

It is important to notice that sensitivity or vulnerability dependence on imports and exports, respectively, may occur even if the physical markets themselves are not considered commercial or political ‘risky’ at all. An exogenous shock in international markets – caused by war or earthquakes, for example, limiting supplies and disrupting pipelines may dramatically change prices even in ‘secure’ markets. In a price shock situation anyone can buy or sell a commodity (unless it comes to an armed conflict with the country itself involved). The problem is that if oil prices increase dramatically, parts of demand in the consuming countries will switch to gas, coal or electricity and push these prices up, as well. Thus, security-of-supply for a consuming country is influenced by the pure physical access to gas, increased economic costs due to a rise in energy prices, and the political pressure that can be brought on them by parties controlling supply elsewhere. Security-of-demand for an exporting country comprises similarly both the risk of a dramatic price drop, (the) economic loss, and adjustments in the economy caused by the loss of revenues and the risk of being subjected to political pressure by parties controlling markets.

In a situation when security-of-supply and -demand problems cannot be solved through foreign policy or market reorganization, the effects of sharp price changes and/or availability, or market access must be addressed by domestic measures. For both importing and exporting countries the ability to domestically adjust to such changes is important in determining the degree of sensitivity/vulnerability in the short and long-term respectively. If a country for example changes from being inelastic (inflexible) in its demand for imports in both the short- and long-term; to becoming inelastic in the short and elastic in the long-term, the country‘s dependence on imports may change from vulnerable to sensitive.

Domestic and external market and political situations together create the character of a dependency on others and whether it should be considered a political problem or not. Domestic and external measures to deal with a problem can consequently also (partly) substitute each other. This can be illustrated by a problematic one-sided dependence on one natural gas pipeline from a source that is considered insecure or antagonistic by an importing country. This country can reduce this to a smaller problem if; a) the supplying (and in some cases the transmitting) country became a more friendly and predictable; b) another pipeline is built with gas from another source; c) the importance of the single supply in the overall energy balance is reduced through energy efficiency measures; d) the ability to switch to alternative fuels is improved, or; e) the country has stocks available that can be drawn on to solve a disruption problem similarly to the Strategic Petroleum Reserves (SPRs) in the oil market, cf. Austvik (2004).

For an exporting country, external measures that improve the relations to importing countries and new pipelines to other purchasing countries (similar to points a and b for importing countries above) would improve the situation. Domestic measures would be to diversify the economy more so as to avoid depending so much on natural gas exports. The country could also refrain from using all revenues as they are earned, and rather gather them in a fund, as is the case in Norway and now also Russia and others.6 A fund can almost eliminate short-term domestic economic problems and sensitivity dependence on prices and markets for exporting countries. The larger the fund, the vulnerability dependence can also be significantly reduced. The dependency issue for exporters will gradually rather focus on the status and development of the fund itself. While stocks for the importing country would be important for improving short-term supply security, a fund for the exporting country would serve both short and long-term purposes.

Having identified short- and long-term energy security risks for importing and exporting countries, respectively, and introduced the concepts of neutrality, sensitivity and vulnerability to characterize the respective parties’ dependence on natural gas trade when availability or prices change, we now turn to the question of how various aspects of market liberalization affects long-term security-of-natural-gas-supply for the EU.

3. Market maturity and impacts from market liberalization

The effects of market liberalization on long-term supply security of natural gas must be assessed in relation to the status and maturity of the market. The evolution of a natural gas market can be described through three stages (Estrada, Bergesen, Moe and Sydnes 1988:3-6).7 The first stage is characterized by a need for large investments both upstream and downstream and the reciprocal dependence on stable demand and supply, respectively, in order to defend investments. If an infantile energy resource is to penetrate energy markets fast, prices must be set lower than its alternatives, and potential buyers must be willing to adapt to new technology and behavioural patterns (cf. Austvik 2003:49). Once consumers have adapted to natural gas, an interdependent relationship between producers and transmission companies is established with long-term commitments to amortize investments.

The second stage is characterized by “an increasingly monopolistic power obtained by the transmission company in an expanding market” (Estrada et al. 1988:4). As new consumers start using gas, the transmission company meets a more diversified demand side, and is able to discriminate between customers. It can also meet more producers at its entry, further strengthening its position as a natural monopoly at both ends of the pipe. The interests of the producer, the transmission company and the customer become separate and more distinct (Davies 1984:53-54).

In the third stage, transmission companies gradually assume the transporter role rather than the merchant role. The maturity of the market leads to some competition with alternative routes of transport, and transmission companies’ operations may also become subject to government interventions. As natural gas becomes important in overall energy balances, it starts to compete with other energy sources more directly. At this stage, prices converge across market segments and energy carriers and links between actors across the gas chain become stronger. The monopolistic position of the transmission companies becomes less predominant, and market transactions are more diversified. Producers and customers have to a degree more purchasers to choose from (gas-to-gas competition). At the same time, however, companies start integrating horizontally (with competing firms) and vertically (with firms further up or down in the gas chain) by mergers and acquisitions, which may contribute to higher concentration around the large champions, if allowed by competition authorities.

The European gas market shares many of these evolutionary characteristics: Since the 1970s there has been a strong concentration of market power virtually throughout the entire chain in the market. The concentrated market structure was natural at a time when the long-term bilateral contracts were necessary for both sides to build the industry and penetrate markets. The long-term contracts strongly contributed to the building of costly production and transport installations on the Norwegian shelf, in Russia and Algeria with reasonable economic security. This was supported by take-or-pay (TOP) clauses in the contracts; if the buyers (transmission companies) were unable to sell their gas, they still had to pay for (a part of) the contracted volumes.8 Both transmission and distribution companies had profit margins associated with low risk in Europe as well as in other gas markets (as for example in the US; EIA 2002). When a contract was signed, a relationship between the price the merchant transporter pays for gas and the price they get was largely fixed, and they were left with the (fixed) difference between these two prices (Austvik 2003:43-47). Hence, producers have taken the price risk in the “old” market and could beneficially take over (parts of) the role as direct purchasers to customers (power plants, large industrial users and local distribution companies, LDCs), using the transmission networks only as transporters and not also as intermediate merchants, in line with growing market maturity. Thus, with growing market size and infrastructural developments, the EU gas market has gradually reached elements of the third stage over the past 20 years, reflected by a much more extensive pipeline network, some storage capacity, and public interventions by using competition law and introducing the gas directives.9

A liberalization, which is “perfect” according to economic theory, is however rarely possible in any gas market. The by-nature non-competitive structure of natural gas transportation activities challenge natural monopoly regulators as they usually must aim at second- or third-best outcomes compared to microeconomic efficiency criteria when transportation tariffs are to equal the average cost (Train 1991:115). There are also commercial and political conflicting interests about market design. One issue is what should be considered an optimal design of a liberalized by-nature non-competitive market, from both an economic and a political viewpoint. Should the liberalization of the European natural gas market follow the principles from the regulation of other non-competitive markets straightforwardly, or should it be given a design attributed to its particularities?

We put forward three main arguments in favour of a modified market design. Firstly, the non-renewable nature of natural gas indicates that the supply side of the market behaves differently than in markets for ‘normal’ goods and services. In most markets prices give signals to change production patterns, while in the case of European natural gas only those few countries with relevant gas resources have this choice (over time nevertheless limited). Sufficient amounts of natural gas will not automatically be produced for the European market when prices go up unless governments controlling resources can and will allow for (or are pressured to) produce more and the reserves are not exhausted. This is exactly why a special branch of economics for non-renewable resources is developed. Secondly, there are long time-lags between when an investment decision is made and when production actually comes on stream. Thirdly, in the EU new gas must come from increasingly more remote fields outside the direct political sphere of the EU.

Hence, market developments in line with evolutionary logic and free market principles are confronted by the fact that natural gas is a non-renewable resource found only in a few places far from markets. Resource economics and international affairs, together with regulatory challenges, influence and constrain the development of what otherwise could have followed liberalization patterns of other non-competitive markets where public utilities dominate. Furthermore, while parts of the market can be considered mature, other parts can still be considered immature in terms of geographic areas as well as in terms of market expansion. To fully reach the third stage of development in the expanding European market environment is consequently an intriguing affair.

Some experience can be learned from other countries’ gas market liberalization efforts. Firstly, in terms of natural monopoly and imperfect market regulations of transmission and distribution activities, gas markets share many similarities. Regulatory experience from the US shows that over time regulations have laid the ground for other problems to come when circumstances are changed and the initial steps taken appeared not only to be inadequate but also were the source of the problems (Broadman 1987).10 The UK also needed a decade to implement policies that de facto fully privatized British Gas (BG) and opened the market. Secondly, in the US, larger and more frequent price variations resulted (California 2006), as well as in the UK when she liberalized its gas market in the 1990s. Prices became more independent from other energy markets especially in the short and medium term. The “Gas Bubble” in the US led for example to lower gas prices after the deregulation in the late 1980s, although it was also caused by lower oil prices at the time. The prices of other energy sources continued to have great impact on the long-term path on gas prices, as well (BP 2007). When American gas prices rose after 2000, it was due to a better balance between supply and demand, but also because oil prices were higher. A liberalized European gas market must also be assumed to lead to higher prices in the short and medium term (which may be as much as 5-10 years) when the market is tight and lower prices when there is a lot of unused capacity . That means that European natural gas prices become more volatile and more independent from other energy prices than in the “old” market.

Thirdly, liberalization also led to larger variations in contractual terms in the UK and the US. When huge new contracts are made directly between producers and customers in the EU, one should similarly expect them to become less long-term than the “old” ones between producers and transmission companies, which were/are of some 20 years duration. Before liberalization, transmission companies balance out geographical and sectorial differences in customer demand. These differences will appear more directly to the producer in a liberalized market. The larger the producer and the more it is possible to take over the wholesaler function of a transmission system, the comprehensive contract portfolio may, however, become so large that fluctuations in individual markets may be balanced against a more even total gas market. The faster and stronger the market responds to a change in supply and demand, the faster the portfolio of long-term, short-term and spot contracts changes. The extent to which this leads to a desire to re-negotiate existing (long-term TOP) contracts in Europe depends on how much the existing contract portfolio resembles the portfolio a given liberalized market would provide. Producers, transmission companies, local distribution companies (LDCs), large industrial consumers and power plants may wish for renegotiations of existing contracts if the portfolio differs a lot, and enter into new contracts when more advantageous, if legally possible. In weak market situations the TOP problems experienced in both the UK and the US could be repeated in Europe. As long as we face generally tight energy markets in Europe and elsewhere, TOP problems should however not become significant in the EU gas market.

Taken together, the more mature the market the more open and flexible it becomes, the easier it is in political terms to take further liberalization processes that a more comprehensive infrastructure and larger market initiated. The degree of market maturity will have an impact on the EU’s chance of succeeding in its liberalization efforts. When markets are immature, a full liberalization can distort the necessary evolutionary processes for the market to mature; “Regulatory frameworks should reflect market realities, i.e. prevailing market structures and market functioning as well as policy objectives that can all vary across countries and regions. Developing markets need a different and a more “managed” regulated framework compared to mature markets” (Correlj?, van der Linde, T?njes and de Jong 2006:47). Price and contractual effects of market liberalization are intended to improve market efficiency. Full liberalization of an immature market can however have long-term negative effects on supply and demand security for importing and exporting countries, due to the huge long-term investments necessary in both upstream and downstream activities. The European gas market is partly mature, but in some parts it is still under development. This partial immaturity of the European gas market largely differs from the UK and US situations when they were liberalized. It also indicates that a single EU policy for all situations in all countries is not de facto applicable.

4. Effects of competition among producers on long-term supply and prices

Competition is generally seen as a prerequisite for markets to work efficiently. Competition lowers costs and improves the quality of products and services. That is however the case when there is free entry to and exit from the market. If this is not the case some degree of market power resides with one or more actors. This market power could be reduced or eliminated by splitting companies and sellers so competition can be activated, and if this is not possible, by regulating the behaviour of the strong player in the market.

For the EU gas market there has been concern about relying too much on natural gas demand, as the few relevant non-EU producers are getting disproportionate market power and the possibility of pressing prices up. A majority of economic analyses show the consequences of Gazprom‘s market power, especially, presenting various models of an oligopoly situation on the supply side (Golombek, Gjelsvik and Rosendahl 1995; Neumann and Hirschhausen 2004; Sagen and Tsygankova 2006). Even though this fear of supply power has clear market logic, the effects on prices and volumes of a concentration on the supply side in markets for non-renewable resources may be quite different in the short- and long-term. While the concentration of supply power often leads to higher prices in the short term, for a non-renewable resource it may give lower prices than a competitive supply side in the long term (Dasgupta and Heal 1979:323-334).

To clarify this argument, assume that the supply side is dominated by a single monopoly. With a linear demand curve, a monopolist‘s price will initially be higher than under competition, as shown in any microeconomic analysis. On the other hand, higher prices encourage conservation and more alternative energy sources to be brought on to the market. Demand for natural gas is substantially more elastic in the long- than the short-term. Therefore, over time, a monopoly leads to lower consumption than competition does. The higher prices also initiate production in high cost areas, which in its turn contributes to suppressing prices. Investment in alternative energies increases. Taken together, the monopolist provides less gas to the market in the short-term and conserves more gas in the ground for future sales than competitive firms. But clearly, the monopoly may charge a very high (and perhaps unacceptable) fee (profit) in order to perform this rationing function.

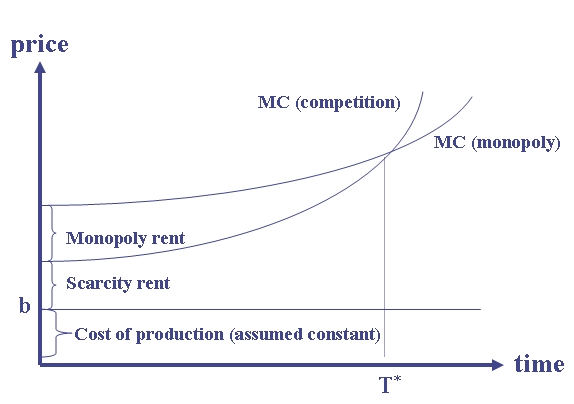

Because the monopoly restricts supply compared to a competitive firm (in order to increase prices and profits) the monopoly better conserves gas and has a lower discount rate than competitive firms, it will initially yield a monopoly rent in addition to the scarcity rent assumed to be earned by all owners of exhaustible resources, cf. Figure 1. Firms competing with each other have higher discount rates, and initially lower profits. However, after some time the competitive price will be higher than the monopolist‘s price; demand is encouraged by lower prices, the resource is exhausted quicker and the emanating resource scarcity pushes prices up. How long time such a process actually takes is, however, difficult to determine and does not only depend on geological occurrences of the resource, but also on technological and political developments.

Figure 1: Price paths under competition versus monopoly

Hence, from a security-of-supply perspective, market efficiency for an exhaustible resource can be considered different than what microeconomic efficiency criteria for the renewables market indicate. A concentrated structure on the supply side may for a non-renewable resource lead to a more stable market development over time than competition does. To make a market for non-renewables efficient and sustainable, dynamic resource management should be included in its design. Resource countries to various degrees include optimization of resource extraction in their petroleum policy. For example, a competitive Russian supply side with many actors involved determining investments according to commercial considerations only, is likely to have significantly different outcomes in the short- and long-term. The evaluation of the scope of a sound resource management may consequently end up quite differently depending on the time horizon for the optimization.

As EU energy consumption also depends on sound management of the resources, a long-term energy policy for the Community should include bilateral and/or multilateral arrangements securing optimal resource management in supplying nations simultaneously with efforts to make the market more efficient downstream. Such policy would help the interests of consumer and producer nations to converge. It would also provide market information and help develop sustainable policies in both exporting and importing countries. Because exporters need revenues and importers need more gas, concerns over long-term supply are shared by both, and should consequently create a foundation for common measures.

This does not mean, however, that market power should be of no interest to the parties involved. The interdependence between exporters and importers and their shared interests does not rule out competition and conflicts. In a market with substantial economic rent over long periods of time (either it is of a scarcity or monopoly kind) gives parties every reason to make efforts to capture it for themselves. Taking rent from someone else in the gas chain may, ceteris paribus, not change the economic considerations for upstream or downstream investments much. If measures are considered not to influence the normal profit of investments adjusted for risk, they may only influence distribution of economic profit (profit in excess of normal profit) between companies and states. A strong market power may also increase political leverage in favour of selling countries in tight markets and purchasing countries in weak markets. This is an often expressed additional concern over Gazprom’s market positions giving Russia the opportunity to develop as a political “energy superpower” (Smith 2006).

5. Downstream liberalization and long-term production investments

Liberalization of the EU gas market contributes to improving the security-of-supply of gas for consuming countries in the short and medium terms by creating an open market with lower prices, by splitting existing producers and production areas in more units, opening the access to pipeline transport and physically building more pipelines and gas storages. On the other hand, more volatile, uncertain and periodically lower producer prices may lead to a drop in large investment projects, especially in weak market situations, and deteriorating security-of-supply for the EU in the long-term. From the outset gas fields are more vulnerable than oil fields in a freer market due to long-term infrastructural development needs and the often bilateral character of single investments. Fields and transmission solutions which do not show the required yield at a given point in time may be delayed. A delay means reduced supply of gas in the long term. Short-term contracts may in this context hardly form the foundation for investments in infrastructure and large development projects for producers. Reduction in long-term supply increases price volatility and, ceteris paribus, tends over time to create higher prices to incumbent producers. Clearly, consuming countries are well served with low gas prices, and they have no reason to give producers any profit beyond normal profit corrected for risk (no economic profit). A high growth in gas demand and low prices will be advantageous for consumers in the short and medium terms. As more volatility and uncertainty tends to give higher prices in the long-term, consumers’ short- and long-term interests are conflicting.

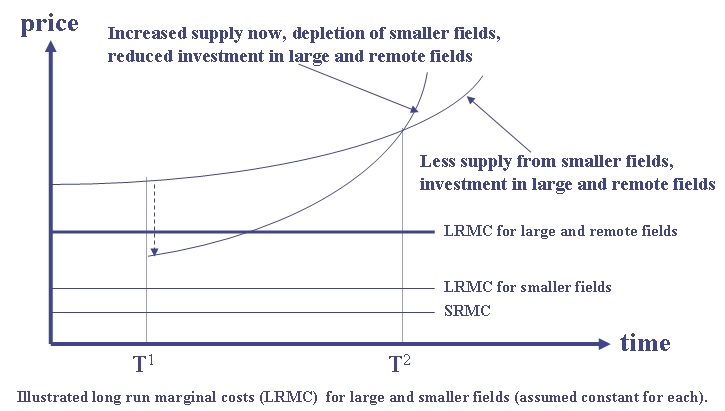

To clarify this point, Figure 2 illustrates a situation where producer prices are dropping at time T1 due to market liberalization; natural gas previously “locked out” from the market is released and market flexibility is improved resulting in a “gas bubble” on the market. The figure illustrates a situation when the price drops below long run marginal costs (LRMC) including a risk premium for large and remote fields (assumed higher than LRMC for smaller fields, although this may not always to be the case). The lower prices lead to higher consumption and absorption of existing capacity at the same time as smaller and marginal fields will more easily be developed. As the price will be lower than the cost of developing large and remote fields, new supplies from these fields will not be realized. Lower and more volatile prices lead to a time lag in investment decisions compared to what is needed to meet demand. In the long run, at time T2, prices become higher than if prices had not dropped at T1. This parallels the short and long-term effects of introducing competition in a monopolized market for a non-renewable resource, as already discussed.

Figure 2: Price paths for European gas with high and low depletion rates

That more volatile, uncertain and periodically lower producer prices may lead to a drop in large investment projects under liberalization is especially important in weak market situations when prices are low. Producers must have long-term profits that give them reason to invest in new, large long-term projects. After the US gas market was liberalized / deregulated in the mid-1980s only marginally new capacity was added (EIA 2001). The lower and more unstable prices were advantageous to consumers in the short-term, but caused problems for the supply in the long-term. If liberalization is to be made fast with wide renegotiations and years of dramatic market moves resulting, it may have serious effects for long-term supplies and investments in future supply is, ceteris paribus, reduced. Therefore, market reform and liberalization should be made in such a way that prices are stabilized over time, to give supply a chance to grow in line with demand, especially in those segments where the market still must be considered immature. In this way security of supply is improved also in the long-term.

For both purchasers and producers market balance is a question about how total supply can be orchestrated over time and across producing nations. Increased supply of gas in the long run may come from regions that already are suppliers to the European continent. In order for new regions to enter the arena, new pipelines and LNG terminals must be built. This primarily applies to fields remote from the European market (the Barents Sea , Central Asia, and Middle East, Nigeria, cf. OME 2002). At oil prices up to 2002, natural gas import price at EU’s borders was some 2.7 USD/mmbtu (BP 2007). This price covered costs of most new production from existing and new suppliers. Three years before however, in 1999, the price of gas was below 2 USD/mmbtu, excluding many of the projects from being realized. Later, higher oil prices and a tight gas market have lifted gas prices that, if sustained, would cover largely all relevant projects; in 2007 the import price of gas to the EU reached as high as 8 USD/mmbtu. Large investments in a liberalized market depend on a continued tight balance between demand and supply as opposed to the long-term planning in the “old” market.

As gas is a non-renewable resource which is found only in a few places that are (potentially) accessible for the European market, prices will over time increase towards the prices of alternative energy carriers and in periods also stay above these prices when gas production from existing/developed areas levels out. The deputy chairman of Gazprom claimed that the EU natural gas market liberalization may “disrupt the entire system of gas security in the region“ (Medvedev 2006). Although market liberalization, ceteris paribus, contributes to delayed production decisions in the short- and medium term, high prices in the long term should release the large projects, but the long-term development will be more unstable than under a more managed market design.

Stern (2001) argues that leaving the TOP contracts and the long-term character of the relationships in the market is a particular problem when markets are immature. When markets are mature liberalization provide more efficient solutions to inter alia security-of-supply problems. “Traditional arguments were more convincing at an early stage of market development; now sound more like reluctance to take risk and defense of monopoly/monopsony positions” (Stern 2005). Accordingly, some projects need exemptions from the second gas directive (EU 2003a) under Article 22 and enter into long-term contracts, while others do not.

Stern (2005) compares two large new projects in northern Europe; Ormen Lange from Nyhamna in Norway to Easington in Britain, and the German – Russian Nord Stream project from Vyborg near St. Petersburg to Greifsvald in Germany, and finds them in largely different situations. Ormen Lange supply contracts is selling into the largest, liquid market in Europe; the UK market is running short of gas and will need substantial new supplies; most equity holders have market operations in the UK and customers on the Continent which give them arbitrage possibilities and recognition that Ormen Lange will be among the lowest cost sources of gas in the UK; and the Norwegian offshore regime is well established. Ormen Lange investors should be relaxed about the project, Stern argues. “A fully liberalized UK market does not seem to deter very large investment projects, even when the profitability of some projects may be questionable given anticipated market conditions” (Honor? and Stern 2005). The Nord Stream project is by Stern (2005), on the other hand, considered a much more virgin project which cannot be built in stages, with high costs and few markets along the route. It will need to be legally unbundled, with long-term capacity contracts and purchase contracts; it is a significant risk when selling high cost gas into a liberalized market.

Hence, the effects of market liberalization on investment in new production and transmission capacity must not necessarily be dramatic in the EU gas market. In a situation with gradual development of transportation capacity and Third Party Access (TPA) contracts, renegotiations of prices may take place as agreed. The part of the EU gas directive (EU 2003a) that states how fast and how much the market should be opened can be considered an expression of this attempt to adjust to a new situation, in addition to the exemptions under Article 22.

6. Taxation on gas consumption adds to investment uncertainty for producers

Parallel to market liberalization efforts, the EU has also been working on the harmonizing of taxation of energy products to replace taxes on labour and income (EU 1997, 2003b). Minimum levels for taxation on gas consumption were here set across the Community and increased as much as for polluting coal. The impression is that these energy taxes are not primarily based on environmental considerations, but rather on fiscal needs and degree of inelasticity of demand (Ramsey taxes, Ramsey 1927An increase in gas excise taxes on consumers may become particularly attractive for consuming countries‘ governments when rent is made available in the gas chain during a liberalization process or prices drop for some other reason. This has already happened in the oil market. When crude oil prices dropped in 1986 and 1991, consumers could have derived the benefit from the loss of rent among producers through lower prices. However, and particularly in Europe, consuming countries raised oil product taxes, which stabilized end-user prices and to some extent suppressed demand and (delayed?) a potential later price rise on crude oil (Reinsch, Considine and MacKay 1994, Austvik 1996).

Taxes on oil products have affected Norwegian natural gas export prices positively and made them more stable than crude oil prices. This is because gas export prices largely have been linked to end-user prices of oil products, including taxes. The divergent development for crude oil and natural gas export prices reflects a far more moderate tax level on natural gas than on oil. Gas usage taxes have, however, also gradually increased. The share of end user prices to households taxes represented 20-50 % in 2006 and 1999, around 20 % in 1994 versus 15 % in 1984 (IEA quarterly). Taxes on gas for electricity production and to the industry are lower and in many countries zero, even though they gradually have increased as well. Even though natural gas usage is taxed low, taxes on polluting coal have been even lower in many European countries. Germany has for instance no tax on coal (actually they subsidize the production of coal). Because natural gas (and oil) prices have been very high after the EU directive (2003b) was approved further increases in taxation of energy have however so far largely been halted.

What would eventually be the effects on natural gas prices of increased and harmonized gas usage taxes across the Union? It is important to note that irrespective of whether a tax is levied on the supply or demand side in a market, its effects on prices and quantities are the same (Pindyck and Rubinfeld 2005:326-329). It is however imperative that the side that is taxed represents a large share of overall supply or demand. This is true when considering the combined EU demand for natural gas, as opposed to demand from a single EU country. If a single country introduces a tax on their consumers only, it will usually not be large enough to have any significant impact on overall volumes and prices in the market, and the tax will eventually be paid by higher domestic consumer prices. When the tax is introduced on a large consumer in a market, demand will be reduced with a following drop in producer prices. The extent to which the tax eventually is paid by producers or consumers depends on the relative price elasticity between supply and demand. It will always be the least elastic side that pays more than half of the tax (ibid.).

For gas consumption taxes, a first effect might however be imagined to be higher consumer prices. If consumers pay for the tax through higher prices, growth in demand will gradually be reduced. If growth is to be maintained, prices to consumers may not be increased and prices in other parts of the gas chain must be reduced to pay for the tax, being transporters or producers. As long as the net prices (the difference between the price they buy and sell for, or a regulated tariff) to transmission (and distribution) operators is rather stable and independent of gas prices (Austvik 1997), the questions remains whether consumers or producers will pay for the tax.

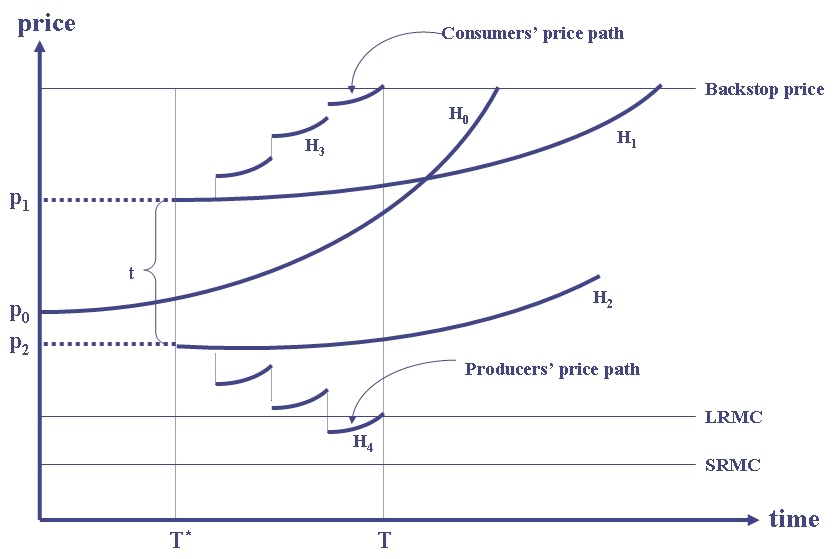

To illustrate these mechanisms, Figure 3 shows a situation with an initially competitive market with gas prices at p0 (only resource rent but no monopoly profit to producers). Prices are expected to increase along the price path H0 up to the backstop (or substitute) price. At time T* consuming countries introduce an excise tax, t, on end-users. With this tax consumer prices shift up to p1 and producer prices drop to p2. If the tax remains at t, consumer prices should rise over time at a slower rate than before the tax. Such a price path is illustrated as H1 while the price path for producers is illustrated as H2. The distance between H1 and H2 equals the constant tax, t. The shift from H0 to H1 represents the same type of effect on consumers as a monopolization of the supply side, as discussed above. The difference is only that consuming countries’ treasuries now get the rent instead of producers.

Figure 3: Consumption taxes and diverging producer and consumer prices

If consuming countries raise taxes over time, the consumers’ price path will make shifts upwards until prices reach the backstop (substitute) price. This is illustrated as the discrete price path H3. While consumer prices make shifts upwards, producer prices make shifts downwards, as illustrated by the discrete path H4. Both the LRMC and short run marginal cost (SRMC) curves are drawn. If producers’ prices are pushed below LRMC following H , they continue producing at existing capacity, but new investments are not made. This will be the case all the way down to SRMC, when production will be stopped. If prices are pushed down only to LRMC, new investments will be made, but no rent collected by producers. The last situation appears to be quite optimal from a consumer country point of view.

The consequences for producers of combined market liberalization and increased taxes on natural gas usage are complex. Increased market liberalization is something producers to some extent (perhaps beneficially) may adapt to through increased downstream activities and development of a more diversified contract portfolio. Taxes on natural gas consumption are, however, in no situation or adaptation to them in the producers’ interest. The worst-case scenario for exporters, perhaps hypothetically, occurs when fields and pipelines are „fully“ developed. At this stage, most producers‘ costs are sunk, and producers have no alternative but to continue supplying gas through existing facilities and grids even though prices are well below what was expected. In the very extreme, if no new capacity can be developed, taxes could ex post be raised to the point where producers‘ prices just cover a little more than the variable costs (SRMC).

Because countries with open trade needs rules for minimum levels for taxation and cost-driving regulations, to avoid a “race-to-the-bottom” development; the EU sets minimum rules for energy taxation, as well as in a number of other fields. For a large importing country, or is orchestrated across a group of countries such as the EU, taxes may however press exporting countries’ prices down. In fact, taxes may be orchestrated across borders in a way that maximizes purchasing countries‘ social surplus in the same way an optimal tariff can do for large importing countries, as we know from international trade theory (Krugman and Obstfeld 2006:70-71, 179-180).11 Furthermore, who gets the tax revenues (which treasury) differs a lot when consumers and producers are in different countries. Thus, national European gas taxes may, deliberately or not, serve a fairly similar function as a customs tariff. Because such processes may lead to pressure on exporting countries’ prices and the distribution of rent among countries, gas taxation may become a major political issue between energy exporting and importing countries as a transfer of money from producers to the consuming countries‘ treasuries.12

Natural gas taxes add to the uncertainty whether there will be sufficient increases in the supply of natural gas to meet demand from the EU. The EU has as a group of countries close to a monopsonistic (single buyer) position in the market. If liberalization takes on a very unfortunate form, for example increased competition upstream and little competition downstream, combined with an aggressive tax policy within the EU area, such as strong escalation of the minimum rates set in the directive harmonizing energy taxes across the Community (EU 2003b), the outcome may have a dramatic impact for producers’ revenues and long-term investments made. To improve security-of-demand it is inter alia for these reasons perfectly rational for gas exporters to diversify their customers. For instance, Russia could increasingly develop alternative markets in the East for Asian customers, and hold back on the development of some large fields.

7. Will the EU or EU member states make the policy?

The policy aiming at making EU gas and electricity markets work in more liberal ways has been a process to open national markets, ease border crossings and enhance competition. The developments are however not uniform across countries. Two main shortcomings can be observed. Firstly, in some EU member states large gas companies have rather consolidated than weakened their positions, as seen for example through the E.on – Ruhrgas and Gaz de France – Suez mergers. In many new member states nationally state-controlled electricity and gas champions are still active (EU 2005a). Secondly, different regulatory practices in member states hamper the free flow of natural gas. The individual nation states define how tariffs and terms of operation are to be determined when adhering to the EU gas directives. The single most important country, Germany, has even chosen negotiated (and not regulated) tariffs. Hence, gas (and electricity) markets have become more open and ‘liberal’ than before, but are in many cases still far from being de facto fully liberalized. Their impediments give an important backdrop for the EU to consider more comprehensive policies to be implemented, including stronger regulations, interlinked with other relevant policy areas concerning security-of-supply, the environment and others (EU 2007a).

The absence of a possibility for the EU to regulate the entire market, including the supply and important parts of the transit side, indicates a need to take further external measures and have dialogues with producing countries. “In order to provide a comprehensive picture on the relationship between Russia and the EU, the focus should be on both the external energy relationship as well as Russia‘s internal organization” (Spanjer 2007). EU (2007a) argues that the Union should speak with one “coherent and credible” voice in (such) external affairs, acknowledging that the EU cannot achieve its energy and environmental objectives only on its own. The common external energy policy should deal with external energy supply crises, and strengthen the Energy Charter Treaty and post-Kyoto climate regime, such as in the relation to Russia and an extension of the emission-trading regime to global partners. In this proposed new (common) European Energy Policy, the idea is to make the plans firmer and move from principles to concrete legislative proposals.

A more comprehensive and perhaps common energy policy including a (federal) regulator at the EU-level may evolve, as proposed in a third gas directive (EU 2007b). There are however more internal obstacles in the EU to do this than in other gas markets being liberalized. In for example the US and the UK, authority rests with national governments in contrast to the largely confederative political structure of the EU. Consequently, a supranational regulator, corresponding to the Federal Energy Regulatory Authority (FERC) in the United States and the Office of Gas and Electricity Markets (OFGEM) in the UK, is so far not found in the EU; “The UK power and gas markets are the most competitive in Europe.” However, “market conditions, attitudes towards liberalization, and levels of competition remain highly diverse across the EU. The EU aim at creating a single European energy market remains a distant possibility rather than an immediate reality” (Energy Business Review June 21, 2007). The role of the European Commission now in intervening into the market may parallel the US federal government‘s role in regulating inter-state trade as far back as in 1938, if successful. Only after 1938 the American federation took control over market regulations across the country (Broadman 1987).

The perspective of getting a common energy policy is supported by a neo-functionalist view saying that economic integration leads to political integration (Haas 1958, Bache and George 2006) with following legal, institutional and ideological change. In this view, the EU should eventually develop towards a federation with an increasingly stronger policy maker in Brussels. This view is however challenged by intergovernmental theorists, beginning with Hoffmann (1966) and followed by political scientists such as Taylor (1983) and historians such as Milward and Lynch (1993) and Milward (2000), claiming that the neo-functionalists underestimate the resilience of the nation-state, and that these will resist the gradual transfer of supranational authority to EU institutions. The bargaining and consensus-building techniques developed in the EU are by these rather considered refinements of intergovernmental diplomacy than ultimate transfer of power to supranational EU institutions (Webb 1977:18). Liberal intergovernmentalists emphasize the bargaining process and power-asymmetries between member states and “package deals and ‘side payments’ as determinants of intergovernmental bargains on the most important EU decisions” (Pollack 2005:18).

March and Olsen (1984, 1989), added that institutions do matter in the study of the processes. Institutions could lead to lock-ins as well as they could provide a path-dependent behaviour among actors. Keohane and Milner (1996:20) argued that “... preexisting institutions allow actors to resist the pressures generated by internationalization”. While neoliberal institutionalists accepted the intergovernmentalists’ assumption of instrumental rationality, and a notion of (fixed) preferences based on a rather narrow definition of self-interest, constructivists challenged this assumption; “… human agents do not exist independently from their social environment and its collectively shared systems of meanings (‘culture’ in a broad sense)” (Risse 2004: 161). Institutions must in addition to formal rules be understood also as how they form informal rules and norms which shape actors’ identities and preferences. Preferences are consequently not necessarily exogenously given as in the rationalist models but endogenously defined depending on institutions, identities and social environment. The “logic of consequentiality” is replaced by the ”logic of appropriateness” (March and Olsen 1989:160). Or stated differently: In the “rational” approach of the intergovernmentalist and institutionalist schools of thought, interests and preferences are assumed fixed and above empirical questioning. In the constructivist school of thought, preferences become an empirical question, and – depending on the research question – an explanatory variable shedding light on political action and negotiating outcomes, and a dependent variable “explained” through constituting, rather than causal analytical frameworks (e.g. “identity”).

The neo-functionalist/intergovernmentalist debates in EU studies are challenged by institutionalists‘ and constructivists‘ debates. Neo-functionalists and constructivists point to the potential for further integration: neo-functionalists through functional and political spillovers, constructivists through changes in identities and preferences resulting from cooperation over time. Institutionalists and intergovernmentalists are more skeptical to both spillovers and socialization. For these the institutional and policy integration is unlikely to change in the foreseeable future (Moravcik 2001:163), and policy will continue to be defined through inter-state processes. Thus, the different debates partly contradict and partly support each others’ view on the progress of EU integration processes and common policy developments.

How can EU energy policy be understood by the schools of thought briefly sketched above? So far, energy policy in the EU has largely been synonymous with competition policy, although elements of the second directive are open for exceptions and the importance of timing of market openings. Competition policy as the fundament for market liberalization represents a unidisciplinary approach addressing the issue mostly with measures and goals taken from regulation of non-competitive markets of “normal” goods and services. It is mostly part of the neo-functionalist school of thought.

In order to improve the shortcomings of the present status of the market, the Commission aims at stronger independent regulatory control, including considering the possibility of setting up a ‘federal’ regulatory body or coordinator at the EU level (EU 2007a). Member states may not, however, necessarily transfer such power to Brussels when considering their relative independence to secure energy supplies. This is for example seen with the German – Russian Nord Stream project, developed in line with an inter-governmental rather than a neofunctionalist view. “Since the European Community came into being, member states have been unwilling to give up their sovereignty in energy matters, considering the stakes to be too high with respect to their national interests in the area of energy dependence and control of their resources” (Finon and Locatelli 2007:21).

The need for a common EU energy policy appears however as evident from overall EU market efficiency and security-of-supply perspectives. Conflicting interests within the Community may, however, obstruct the realization of such policy. Because natural gas appears to be a strategic commodity, each country may wish to secure itself rather than primarily be concerned with the situation for the entire Community; to the extent these goals contradict each other. Overall integration trends on national levels as well as specific market integration will be important, and can vary across countries. Consequently, both countries and specific market segments may continue to integrate with differentiated speed and scope.

In Chapter 3 in this volume, Andersen and Sitter observe that the impact of European integration may vary almost as much within as between sectors, as well as between countries. In the case of natural gas some states progress quickly towards liberalization while others make only minimal efforts. In effect, the Commission’s drive for liberalization yields homogeneous integration only with respect to limited policy initiatives. “The move to competitive markets in the energy sector, as in many other sectors, is better characterized as aligned or autonomous integration” than as homogeneous integration. The exception is the UK where EU directives could legitimize national practices that were already in place. For other states, EU demands for particular organizational and behavioural patterns appears as weak, and the local pressure to maintain existing practices remains strong. EU level decisions often omit sensitive issues for member states; objections to regulatory simplifications lead to rules that accommodate national demand for autonomy and regulatory diversity.

However, not supporting common actions involves costs for member states. Policies may continue to be harmonized, but national and commercial actors and actions will most likely also remain important. A full liberalization of the intra-EU market according only to competition principles appear nevertheless as less likely, if not impossible. Core countries will most likely (also) take national steps on their own to improve their energy situation. However, over time common policies may gradually become more important, especially if / when prices are dropping, and the scarcity and international aspects of the market appears as less dominant as when prices are high.

For the supply side it is important to which extent the EU or EU member states de facto will determine policy in the field. In imperfect and politicized markets the opportunities for policy making and entrepreneurial actions increase on both commercial and political levels. It influences the way Russia and others will play on EU member states and the EU itself, respectively, when understanding and influencing the shaping of their future commercial and political domestic and downstream market maneuvering space as natural gas exporters.

8. Concluding discussion: Security-of-supply and limits to market liberalization

More pipeline routes, LNG supply and terminals, storage facilities and the possibility for open market transactions improve the security-of-supply and security-of-demand situations. However, the interdependence between the EU, EU countries and supplying nations of natural gas cannot be completely neutral in the future. Competition, when achieved, creates some problems upstream affecting EU supplies in the long run, unless arrangements are found to secure long-term investments.

Periods with high energy prices with following security-of-supply concerns have together with environmental challenges triggered new policy initiatives by the EU. Policies that aim at improving competitiveness, supply security, or the environment however often contradict each other. For example, switching fuels from domestic coal to imported gas reduces CO2-emissions, but contributes to increased dependence on natural gas imports. Most important elements in intra-EU policies appear to be improved energy efficiency and flexibility in terms of ability to choose between transport alternatives, energy carriers and suppliers. These measures help all three main EU energy and environmental objectives; competitiveness and the Lisbon agenda; environmental protection and the Kyoto protocol; reduction of energy imports. Policies aiming at identifying the bottlenecks preventing cost-effective improvements from being captured, such as lack of incentives, information, financing, relevant tax structures, law making and others are also important.

Accordingly, the EU Commission has increasingly focused attention on coordinating policies for the three areas (EU 2005b, 2006). Under the 1997 Kyoto protocol, the EU is obliged to reduce its greenhouse gas emissions to 8 % under the 1990 level by 2008- 2012. In 2003, the EU Parliament and Council issued a Directive (EU 2003c) establishing a greenhouse gas emissions-trading scheme, which became operational in January 2005. According to this directive all emitting undertakings must hold an emission permit from its government. Emission-needs higher or lower than the allocated emission rights, can be bought and sold on the market or saved for future use.

Furthermore, in the “An energy policy for Europe” report (EU 2007a) the Commission sets up a goal of a 13 % reduction in energy consumption by 2020 compared to 2006, due to a 20 % saving through improved energy efficiency. To improve the environment, the Commission proposes that 20 % of its energy mix should come from renewables by 2020 (from the present 6 %), whereas biofuels should have a minimum target of 10 %. Energy research should increase by at lest 50 % over the following 7 years, with the aim of being in the forefront of the rapidly growing low carbon technology sector. Development of cleaner coal-based electricity plants should be emphasized, as reserves for coal are substantial also within the EU. Both coal and gas-based power plants should develop a program for CO2 capture. If these proposals are implemented, the EU will be a global leader in efforts to reduce environmental damage from human activity.

The proposals comprise acceleration of and emphasis on all the processes already contributing to energy savings. Through these “domestic” measures the EU improves its energy security situation, by reducing its sensitivity to short-term disruptions as well as to dependency on more natural gas supplies in the long-run, and consequently expands the maneuvering room for furthering market flexibility and openings. To what extent such policy should follow general competition principles or is modified with respect to the particularities of natural gas as an imported non-renewable resource is debated. Also the effects of the political uncertainty about ex post higher natural gas usage taxes on producers’ investment decisions should be addressed; higher taxes on natural gas consumption help the environment and generates revenues to the respective treasuries, but may also press export prices down after their investments must be considered sunk.

If one disregards the international aspect of the issues, attempting to set up a European (and not only an EU) regulatory authority, the exhaustible character of the resource will still challenge general competition principles in the long run. The by-definition scarce character of natural gas resources is hardly mentioned as a special constraint for long-term supply in EU documents at all. Rather, discussions are kept within the framework of contestable markets and how to deal with non-competitive aspects of these. Disregarding this aspect and continuing to base economic growth on natural gas (and oil) as strongly as previously planned, could however move EU economies from being sensitive to changes in prices and availability of the resources, to being vulnerable in the long-run.

The principles of competition are gradually challenged due to the high prices, but largely expressed as an element of the conflict of interest between outside producers and the EU. At the same time as desires for a common energy policy are put forward, the EU sees it as beneficial that she has large companies in the energy sector to maintain a strong buying power towards exporters, even if the excessive market power resulting in certain regions can limit the benefit of and possibility for competition (EU 2005a:18). Even the possibility of creating a single buyer on the EU side to exploit its monopsonistic market position to counteract exporters’ market power is discussed (Finon and Locatelli 2007:24-28). The political economy of European gas clearly indicates that “…what is economics for one actor in a market might be politics for another” (Claes 2001:368).

Hence, constraints for successful EU natural gas market liberalization including the issue of security-of-supply are economic, geological and environmental. In Europe these constraints are not only an intra-EU matter, but part of an international political framework including relations to and situations in Russia, Central Asia and the Persian Gulf as suppliers and Ukraine, Turkey and others as transit countries. There is a need for the EU and EU member states to further external measures and dialogues with these countries to balance out the elements of conflicting interests in how producing countries behave and how the EU organizes its markets, and hence contribute improving both supply and demand long-term security.13 In this way both the international aspect of the European gas market is respected, and probably also the scarce nature of the natural gas resource.

At the same time, internationalization and global market integration is gradually changing the form of interdependence between market actors in natural gas markets. When expanding supplies to Asia, Russia reduces its dependency on the EU as the dominant purchaser. When the EU diversifies import opportunities towards the Middle East and Central Asia (as in the case of the Nabucco pipeline project), its security-of-supply situation improves. As Norway has started to sell Liquefied Natural Gas (LNG) from the Sn?hvit field to the US also its dependency on pipeline transportation and the EU as the only purchasers is modified. Gas markets are becoming more global and dependency of single sources and markets is gradually reduced for many actors. The longer these processes are developed, the less important will be bilateral affairs and the gas industry will look more like the oil industry (although by no means become similar). The security-of-supply and security-of-demand issues then tend over the long-term to be an issue whether prices are too high or too low and degrees of price volatility, such as is largely the case in the global oil market.

To what extent do the present organization of gas markets in Europe and the level and content of common EU policies in the energy field satisfy concerns about security of supply? The second gas directive (EU 2003b) opened for some adjustments in market design attributed to its particularities such as speed of market openings and exceptions for immature market segments. The new policy initiatives in 2007 (e.g. EU 2007a) brought together more policy areas, leading to the idea of more supranationality within the Union. These initiatives indicate that the issue of security-of-supply, the inherent imperfections of the natural gas market, and the interaction between relevant policy areas affecting the EU energy situation, gradually are taken more seriously. Whether the Union will speak with one “coherent and credible” voice in external and/ or internal affairs is not obvious; member states can continue to be unwilling to give up too much sovereignty in energy matters with respect to their national interests in the area. It appears rather doubtful that the EU will manage to set up a regulator at the EU level which de facto harmonizes transportation tariffs and practices across the Union (EU 2007b), although it is more likely that she can do it de jure. This is what Andersen and Sitter in this volume phrases; “ ’fuzzy liberalization’ – universal free market rules that are open to a wide range of interpretations by governments, companies and the courts – is becoming the norm, even when there is broad agreement on liberal market principles”.